Another Dravidian Stockist journalist spread misinformation about the Repo rate hike, attempting to emotionally provoke people and conceal the DMK’s rate hike affecting textile industries.

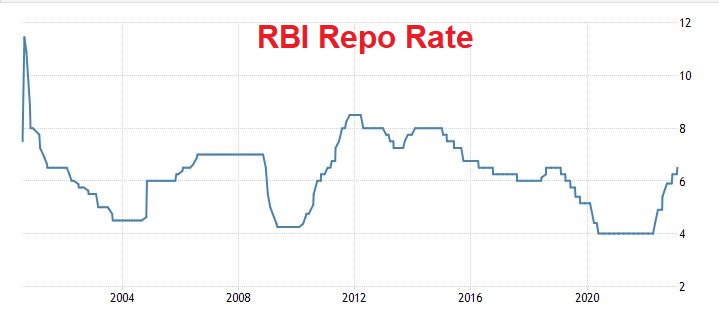

The Reserve Bank of India’s Monetary Policy Committee (MPC) raised the key policy rate, the repo rate, or the rate at which the RBI lends funds to banks, by 25 basis points to 6.50 percent on Wednesday (9 February 2023) in an effort to contain retail inflation. The RBI decision is expected to increase the cost of all external benchmark-linked (based on the repo rate) loans immediately.

It should be noted that the interest rate cycle is closely related to the economic or trade cycle. In theory, movements in interest rates should mirror the economic cycle. If the economy is growing strongly and inflationary pressures increasing – Central Banks will increase interest rates to slow down the economy and prevent inflation. If the economy enters into recession with falling inflation and rising unemployment – Central Banks will cut interest rates to provide an economic stimulus to try and increase the rate of economic growth.

Following the rate hike, the DMK IT wing and DMK supporters masquerading as journalists spread misinformation about the rate hike. In one such attempt, Puthiya Thalaimurai journalist Niranjan Kumar said, referring to the rate hike, “Let the dream of buying a house remain a dream till the end.”

Lakshmi Subramanian, the senior correspondent of The Week, is the latest Dravidian Stockist journalist spreading misinformation about the Repo rate hike. On Friday, she took to Twitter to spread misinformation about the rate hike. She stated, “The interest rate on a home loan is 11%. You will not have a good life,” and attempted to incite people’s emotions against the BJP.

Though increasing interest rates to control inflation is a normal procedure, and central banks all over the world are doing so, a journalist who should know better is using it as an emotional tool to spread misinformation about rate hikes.

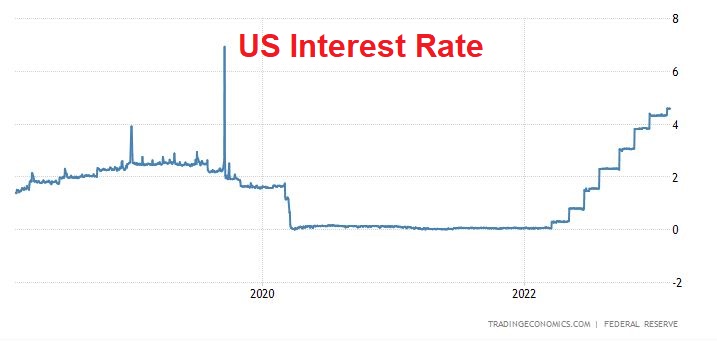

Also, in the United States, which has lower average inflation than India, the Federal Reserve has raised interest rates from 0.25% to 4.75%, a 4.5% increase from the low during the COVID pandemic. However, the RBI raised interest rates from 4% to 6.25%, an increase of only 2.25% from the COVID low, demonstrating that the BJP government has effectively controlled inflation in comparison to the US.

During the previous Congress regime, the interest rate hike cycle saw a peak of 9% in July 2008 and 8% in January 2014.

Several users also questioned Lakshmi Subramanian on where she obtained her home loan, as many banks offer home loans starting at 8.5%, raising the question of whether she actually has a home loan or just said it to insinuate hatred against the BJP.

Several users stated that they, too, have a home loan and do not pay the 11% interest rate. Home loans are typically the least expensive of all loans because banks have the authority to seize the property if the borrower defaults. With the RBI Repo rate at 6.25%, the cheapest of all loans, the home loan, cannot be 11%, as stated by Dravidian Stockist journalist Lakshmi Subramanian.

And she calls herself a journalist . These have people have zero shame https://t.co/WjNhJzeNkk pic.twitter.com/EnU4EOCiym

— kishore k swamy 🇮🇳 (@sansbarrier) February 11, 2023

Some Twitter users claimed that Lakshmi Subramanian’s tweet was a ploy to divert attention away from the power tariff hike faced by Tamil Nadu’s textile industry and that the Erode East which is going for the by-election is known for its textile industry. They claimed she tried to save the DMK government, which is facing its first by-election.

Click here to subscribe to The Commune on Telegram and get the best stories of the day delivered to you personally.