The Old Guntur Police have registered a criminal case against Bishop Jayarao Polimera of the Roman Catholic Diocese of Eluru and several others, following allegations of large-scale fund diversion and administrative interference in the Prema Seva Charitable Trust, based in Gowripatnam, West Godavari district. The FIR, dated 15 November 2025, invokes Section 420 IPC read with Section 34, as the alleged offences occurred before the introduction of the Bharatiya Nyaya Sanhita.

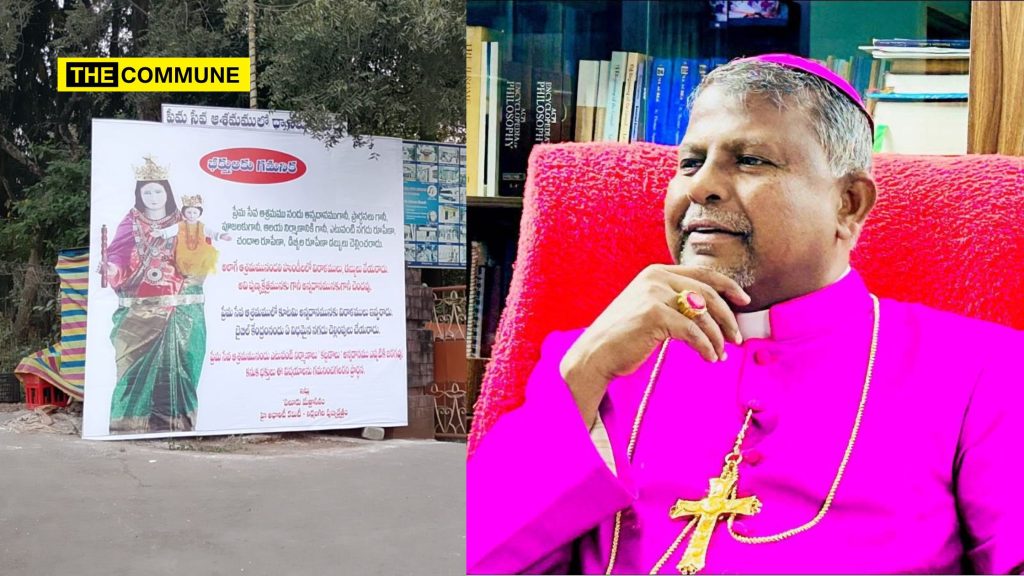

The case was initiated on the basis of a detailed complaint filed by Guntur-based social worker and RTI activist Potumeraka Lakshmi Durga (40). In her complaint, she accused the Bishop and his associates of misusing religious authority, disrupting the Trust’s long-running free-meal (Nithyannadanam) programme, and diverting public donations meant for serving pilgrims and the poor.

Allegations of Misuse of Funds and Interference

According to the complainant, the Trust, holding FCRA licence No. 010180182, has been providing free meals to thousands of pilgrims for decades and has received nearly ₹7.5 crore in donations, including contributions mobilised from Hindu donors. She alleged that after Bishop Jayarao assumed charge of the Eluru Diocese, he and his aides began interfering in the Trust’s operations, despite having no official role in its administration.

The complaint names Father Raju, Moses, Dhara Ravi, Father John Peter, and contractor Nageshwar Rao among those allegedly involved in diverting donations, withholding meals from visiting pilgrims, and collecting cash from devotees without issuing receipts. These unrecorded collections were allegedly split among the individuals involved, with a portion purportedly routed to the Bishop.

The complainant further claimed that banners were displayed within the Trust premises advising pilgrims not to donate, stating that contributions would be misused. She alleged that announcements were also made on loudspeakers, creating widespread suspicion about the handling of funds.

₹31 Lakh Transfer at Centre of Complaint

One of the key allegations concerns the transfer of ₹31 lakh on 2 May 2025, from the Trust’s bank account to the Diocese’s account through a cheque reportedly signed by an unauthorised person. While the amount was said to have been returned to the Trust after bank officials realised the legal and procedural issues involved, the complainant alleged that the Bishop had influenced bank authorities to avoid consequences.

She characterised the episode as a “clear case of criminal breach of trust” and sought action against all those involved, including the bank manager. She also demanded restoration of the Annadanam programme in accordance with the Trust’s bylaws and donor intent.

Zero FIR Registered; Case Transferred for Investigation

Old Guntur Police registered the complaint as a Zero FIR and transferred it to Devarapally Police Station in West Godavari district, the jurisdiction in which the Trust operates, for a full investigation.

LRPF Files Separate Complaint With Bank Over Alleged Fraudulent Transfer

In a parallel development, the Legal Rights Protection Forum (LRPF) filed a separate complaint with the Nodal Officer of South Indian Bank, seeking a probe into what it described as an unauthorised and fraudulent transfer of ₹31 lakh from the Trust to the Eluru Diocese.

LRPF alleged that the cheque used (No. 1005922) carried the signature of an individual not recognised as an authorised signatory by the bank’s records. The organisation stated that the transaction violated banking due-diligence norms, including:

- RBI Master Direction on KYC (2015-16)

- RBI Master Circular on Customer Service (2015-16)

- RBI Internal Control and Anti-Fraud Guidelines

The complaint contended that processing a high-value cheque without proper verification constitutes a breach of Sections 46 and 47A of the Banking Regulation Act, 1949, which place accountability on bank officials for regulatory lapses.

LRPF argued that the incident also qualifies as a case of “deficiency in service” and “unfair banking practice” under the RBI Integrated Ombudsman Scheme, 2021, and requested immediate action, including an internal inquiry by the bank.

As per information, Rs 31 Lakhs of Prema Samajam Charitable Trust funds were illegally cheque-Transferred to Eluru Diocese, AP (both FCRA-registered) on 2nd May 2025, using unauthorized signatures.

Wrote to @OfficialSIBLtd higher authorities & @RBI CGM seeking inquiry & action https://t.co/aKesZwkVLq

— Legal Rights Protection Forum (@lawinforce) November 3, 2025

(Source: Arise Bharat)

Subscribe to our channels on WhatsApp, Telegram, Instagram and YouTube to get the best stories of the day delivered to you personally.