On October 24, 2025, The Washington Post dropped its report, “India’s $3.9 billion plan to help Modi’s mogul ally after U.S. charges,” and what followed was a storm of headlines and political outrage—chiefly a chorus from the Congress party. But look beyond the dramatic prose and you’ll see a narrative fueled more by conjecture and innuendo than fact. The reality: this “exposé” is not the triumph of investigative journalism it claims to be, but a textbook case of selective storytelling and agenda-driven framing.

The Anatomy of a Manufactured Scandal

The Post alleges a secret government push, orchestrating a ₹33,000 crore ($3.9 billion) LIC bailout for the Adani Group—a storyline built on anonymous sources, never-before-seen “internal documents,” and hearsay. But here’s the rub: According to clear, repeated statements from LIC and senior government officials, no such scheme exists. LIC’s investments are guided by merit, rigorous risk assessment, and policyholder safety—not political diktat or backroom dealings. LIC officials and their own corporate governance rules (the LIC Act, SEBI and IRDAI regulations) all enshrine independence—the kind that withstands both market shocks and media trial.

Former LIC Chairman Siddhartha Mohanty wasn’t subtle when he called the Washington Post’s story a “misleading narrative,” grounded in ignorance, not evidence. The Post’s refusal to seek direct comment from LIC or Adani betrays its preference for drama over diligence.

LIC’s Real Story: Scale, Prudence, and Professionalism

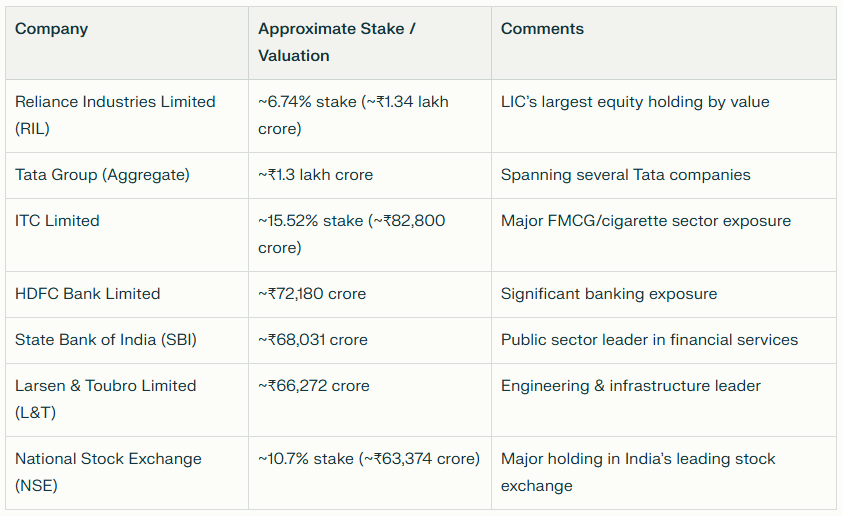

Let’s check the numbers. LIC’s equity holdings are India’s backbone, not Adani’s lifeline. From ₹2.55 lakh crore in 2013-14 to ₹13.01 lakh crore in 2024-25, LIC’s portfolio has ballooned in both diversity and dynamism. Its record profit—₹48,151 crore in FY 2024-25, an 18% jump—stands testimony to professional stewardship.

Here’s what the Washington Post won’t tell you:

LIC’s annual investment outlay exceeds ₹5.5 lakh crore, yet its stake in Adani? A mere 4.5% of its total equity, under 2% of Adani’s debt. The supposed “bailout”—a ₹5,000 crore bond subscription in May 2025—was a routine, AAA-rated corporate investment with yields above government securities. By fixating on Adani, The Post hopes you’ll overlook the seventy giants in LIC’s true portfolio.

Adani Group: Global Trust, Not Political Patronage

After the Hindenburg saga, Adani faced a barrage of probes—SEBI cleared the group of any systemic wrongdoing. Since then, global capital has poured in: a $1 billion QIP oversubscribed by titans like Goldman Sachs, Nomura; BlackRock, Apollo and international banks happily taking up Adani debt. That’s hardly the behaviour of a market pariah. LIC has seen profits, not losses, on Adani investments. Claims of a multibillion-dollar hit are pure fiction.

Congress: Dancing To Foreign Agenda

The timing of all this outrage? Impeccable. With Indian markets soaring and Adani surmounting legal battles, Congress seized The Post’s narrative, pushing slogans and panic, painting prudent investing as corruption—from the masters of middlemen and cut-deals. The hypocrisy is staggering: Congress built a legacy of policy-for-payout, yet now pontificates about financial integrity.

Who’s At Risk? Not India’s Savers

Does LIC endanger its 14 crore policyholders? Fact: Its ₹50 lakh crore asset base is fortress-strong, with consistent dividends and record profits. Adani is a fraction of a fraction; the real danger comes from manufactured agitation—spooking investors, risking genuine losses, and eroding trust for political sport.

A Call for Accountability in Journalism

The Washington Post must do better. Verify with LIC and Adani, reveal your sources, retract what cannot be proved. Transparency is the oxygen of credibility; speculation is poison. This “scoop” isn’t reporting—it’s market sabotage disguised as journalism, amplified by Congress’s political ambitions.

Final Verdict: India’s Market is Built on Merit, Not Manufactured Scandal

LIC’s stewardship, Adani’s resilience, and India’s economic boom are real—The Post’s narrative is not. Sensationalism may drive clicks, but the facts drive India’s growth. It’s time global media and partisan politicians learned the difference. The country’s savers deserve no less.

Subscribe to our channels on WhatsApp, Telegram, Instagram and YouTube to get the best stories of the day delivered to you personally.