Tax professionals and Chartered Accountants in Tamil Nadu note that over the last one year and especially over the past three months, there has been a marked increase in the number of detentions of vehicles and goods by state government officials over zero or minor procedural lapses with lakhs of rupees imposed as fines on small businesses.

The state government officials have been imposing penalty to the tune of several lakh rupees for the release of the detained vehicles and goods.

Refusal To Understand Law

According to sources, inability of the Commercial Tax Department officials to understand basic law and refusal to accept the procedural guidelines issued by the Central and State GST authorities from time to time are putting small businessmen to harassment.

The GST law recognizes the possibility that “buyer” (one who pays for the goods) and “consignee” (one to whom the goods are delivered) can be different. It is like a person ordering a gift for a friend online where the buyer (the person one who orders and pays for the item) is different from the receiver of the item (the friend).

However, in the wisdom of the state government officials (the Roving Squad, as they are called as, in their brand new White Mahindra Scorpios), this is seen as illegal. According to them, the buyer and consignee should be the same.

Daylight Extortion

In one instance, which happened on 19 August 2022 (Friday, a public holiday in Tamil Nadu on account of Krishna Jayanthi), a vehicle from Karnataka, which was parked outside the intended destination was detained despite having the necessary documents.

The invoice raised by the supplier was also supported by another legal document, known as the E-Way Bill. The E-Way Bill is a document submitted online containing details of the seller, buyer, and consignee, etc.

However, the vehicle which was parked was detained and driver was asked to pay a penalty of ₹5 lakh for the release of the vehicle and goods. The driver, a Kannada speaking person who doesn’t understand Tamil, was given a handwritten note by the officials in Tamil stating that they have explained the provisions and violations to the driver in Tamil and that he has acknowledged the same.

In another instance on 16 August 2022, the goods were transported under the cover of a Taxable Invoice which evidences the seller’s obligation to pay the taxes on the same. But there was a failure to generate the E-Way Bill online. When the vehicle was detained by the state government’s Scorpio-equipped Roving Squad, they imposed a penalty of ₹5.60 lakhs. The penalty imposable under the GST laws for this minor lapse is only ₹10,000 as there is no tax amount being evaded, as evidenced by the invoice containing the full GST details of the seller and the buyer.

In many instances, the goods are typically detained on the last working day of the week, with an active threat of not releasing the goods or the vehicle for atleast two three days, unless the “tax amount evaded” is paid along with “penalty”.

“And all these are in addition to the ‘usual lubricants’ to smoothen the goods release process.”, a furniture store owner from Chennai who wished to remain anonymous noted.

Officials Given ‘Collection Target’ From Higher Ups In The Govt

Professionals who regularly handle all such GST litigations note that over the past few months, the Tamil Nadu Commercial Tax Department officials have been relentlessly detaining and seizing goods, sometimes including those with all proper documents, and releasing them only upon payment of penalty.

“When interacting with the department officials over this, seeking which provision of law they are invoking to impose the penalty, they are all the more happy to say that we can file an appeal. But it takes couple of months for the appeal to be disposed off. The other alternative is to go the High Court by filing a writ petition, and that takes two weeks on an average. And no businessman is having the resources or time to go through these hassles.”, a Chennai-based Chartered Accountant noted.

After continuous prodding and repeated pleading by tax professionals explaining the difficulties faced by the traders, the state government officials admitted that they have been given a “target” tax collection.

Similar feedback was received from a few other tax professionals and traders, who concur that the state officials are given instructions for revenue target, and consequently, they are resorting to seizing of many vehicles on regular basis.

“Despite proper documentation they have been imposing penalties upto 200% of the tax amount. This is not even harassment. It is just daylight extortion.”, a Chartered Accountant who wished to remain unidentified told The Commune.

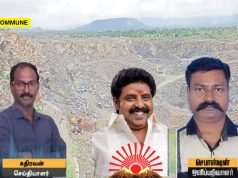

“The high-handedness of the Tamil Nadu government officials and blatant disregard for the law of the land is appalling. The pressure seems to stem from the higher ups in the state commercial taxes ministry headed by P. Moorthy and finance ministry headed by PTR Palanivel Thiagarajan.”, he added.

Tax professionals note that with the complete digitization of GST compliances and almost nil face-to-face interaction, “opportunities to earn” by the state government officials have dried up in the last four years.

The state GST officials seem to have finally figured out a way to ensure their “constant source of income”, they said.

It is noteworthy to mention that Tamil Nadu Finance Minister Palanivel Thiagarajan has been a vocal critic of the GST on the grounds that the taxation powers of the state have been reduced.

Almost a year ago, certain “tax collection efforts” by service of “Ink-Signed Tax Demand Notes” in Nagaland were in the news. Similar “tax collection” was also pretty rampant in Arunachal Pradesh, all aggravated by the financial crunch arising out of the Chinese Wuhan Coronavirus pandemic. These were illegal tax collection by extortionists and anti-national forces, comprising of the insurgent groups like National Socialist Council of Nagaland and its various factions. Failure to pay such tax resulted in penal consequences.

Tamil Nadu government officials seem to have taken a leaf out of north-east’s book.

“The much-hyped ‘Dravidian Model’ of tax collection seems to be a model of extorting small businesses at the cost of overall development of the state. Such extortionary practices by state government officials is sure to affect the business climate in the state.”, the Chennai-based CA dealing with these litigations noted.

Inability to figure out ways to raise revenue, address leakages in sectors like electricity, and now the state government resorting to these methods shows that the Tamil Nadu Finance Ministry is completely clueless, if not lazy.

Click here to subscribe to The Commune on Telegram and get the best stories of the day delivered to you personally.