COVID-19 has drastically affected the investment climate in all economies of the world, causing a sharp decline in the demand and supply equilibrium everywhere. India has been no exception to this unprecedented economic shock.

However, propagandists masquerading as economists and public policy experts have been taking to the columns of top international media like New York Times, Washington Post, Wall Street etc., to paint a negative picture about India.

But their propaganda has been punctured with the recent numbers of Foreign Portfolio Investments (FPI), Foreign Direct Investment (FDI) and Corporate Bond Market.

These numbers indicate that the investment sentiment in the Indian economy has been buoyed by the frequent and active intervention of the Government of India despite being hit by a world-wide pandemic. The trends in FPI, FDI and Corporate Bond Market flows underline the beliefs of investors in the strength and resilience of Indian economy.

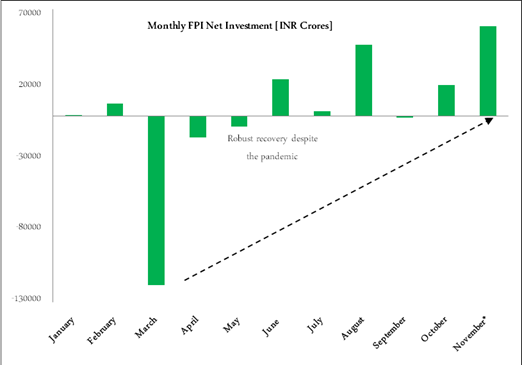

In the last two months (October and November 2020), FPI inflows have witnessed a significant resurgence which has primarily been by equity inflows resulting in the highest ever FPI inflows for a month for India. As of 28th November 2020, FPI inflows stood at ₹62,782 crore. Of this, equity inflows amounted to ₹60,358 crore while FPI net investment in debt and hybrid was to the tune of ₹2,424 crore. The highest inflow in total FPI investment was witnessed on 12th November, marking a single day peak of ₹11,056 crore.

In the equities segment, the inflows in November 2020 is the highest amount of money invested ever since FPI data has been made available by the National Securities Depository Ltd.

FPI flows are known to be less resilient and more sensitive to changing market conditions. Investment through the FPI route are therefore gauged through the metric of net inflow and outflow. In October and November 2020, India saw large inflows through FPIs.

With respect to FDIs inflows into India during the second quarter of financial year 2020-21 (July, 2020 to September, 2020) have been US$ 28,102 million, out of which FDI equity inflows were US$ 23,441 million or ₹174,793 crore. This takes the FDI equity inflows during the financial year 2020-21upto September 2020 to US$30,004 million which is 15% more than the corresponding period of 2019-20. In rupee terms, the FDI Equity inflows of ₹224,613 crore are 23% more than the last year. August, 2020 has been the significant month when US$ 17,487 Million FDI equity inflows were reported in the country. Both FDI equity inflows and total FDI inflows into India have shown a secular rise over the years, with 2019-20 the year with the highest FDI in the last six years. The measures taken by the government on the fronts of FDI policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country.

Total FDI Flows (US$ Million)

| Year (Financial) | FDI Equity Inflows | Total FDI Flows |

|

2014-15 |

29737 | 45148 |

|

2015-16 |

40001 | 55559 |

|

2016-17 |

43478 |

60220 |

| 2017-18 (P) | 44857 |

60974 |

|

2018-19 (P) |

44366 |

62001 |

| 2019-20 (P) | 49977 |

74390 |

(Source: DPIIT)

In H1 FY21, the total corporate bond issuances amounted to ₹4.43 lakh crore, 25% higher than ₹3.54 lakh crore in the same period last year. The narrowing spread with GSecs stands testimony to the improved risk perception of corporate bonds. Further, the cost of funds also moderated for both the Government and the corporate, on the back of RBI’s monetary easing and liquidity infusion, thereby bringing down yields in the various segments of the debt markets.

Thus, once again it has been proved that Indian economy runs on the strength and economic prowess of hardworking Indians and not arm-chair commentators of economy.