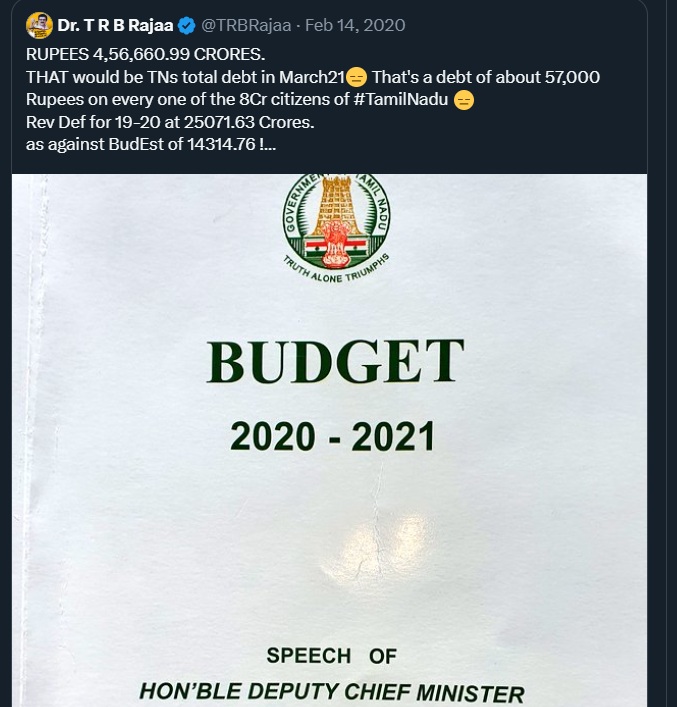

A five-year-old social media post made by DMK minister TRB Rajaa, when the DMK was in opposition, has resurfaced amid growing scrutiny of Tamil Nadu’s sharply rising debt under the party’s own tenure.

In 2020, Rajaa had publicly ridiculed the then AIADMK government over the State’s debt levels. In a post on X (then Twitter), he wrote that Tamil Nadu’s total debt would touch ₹4.56 lakh crore by March 2021, translating to roughly ₹57,000 per citizen. He had also flagged revenue deficit figures, contrasting actual numbers with budget estimates to accuse the AIADMK of fiscal mismanagement.

Five years later, the figures have grown significantly larger under the DMK government. According to the latest budget documents, Tamil Nadu’s total outstanding debt is projected to reach ₹9.29 lakh crore by March 2026. This amounts to an estimated ₹1.16 lakh per citizen, assuming a population of around eight crore – more than double the per-capita burden Rajaa had highlighted while in opposition.

RUPEES 9,29,959.30 CRORES.

THAT would be TNs total debt in March26😑 That’s a debt of about 1,16,000 Rupees on every one of the 8Cr citizens of #TamilNadu 😑@TRBRajaa https://t.co/61FwN2eubB— BJP Tamilnadu (@BJP4TamilNadu) December 30, 2025

The resurfacing of the tweet has coincided with renewed debate over the DMK’s handling of state finances, particularly in the context of the party’s 2021 electoral promises of “Vidiyal” (dawn) and a distinct “Dravidian model” of governance.

White Paper Promises vs Budget Outcomes

Shortly after assuming office in 2021, then Finance Minister Palanivel Thiaga Rajan released a high-profile White Paper on Tamil Nadu’s finances. The document blamed the previous AIADMK regime for what it described as fiscal mismanagement, claiming that debt had risen to about ₹2.63 lakh per household. Rajan had pledged that the DMK government would “set right” the fiscal situation within five years through major reforms and a dramatic transformation of public finances.

However, subsequent budget documents indicate that the debt burden per household has increased substantially during the DMK’s tenure. Based on an estimated two crore households, the per-family debt has risen to approximately ₹4.65 lakh by 2025–26—an increase of about ₹2.02 lakh per household since 2021.

Rising Debt Trajectory

Official figures show a steady year-on-year rise in borrowing:

2021: Total debt of ₹5.7 lakh crore (₹5,70,000 crore) that translates to ₹2.63 lakh per household (White Paper baseline)

2022: Total debt of ₹6.67 lakh crore (₹6,67,975 crore) that translates to ₹3.34 lakh per household (27% increase)

2023: Total debt of ₹7.41 lakh crore (₹7,41,497 crore) that translates to ₹3.70 lakh per household (41% cumulative increase)

2024: Total debt of ₹8.34 lakh crore (₹8,34,544 crore) that translates to ₹4.17 lakh per household (59% cumulative increase)

2025: Projected debt of ₹9.29 lakh crore (₹9,29,959 crore) that translates to ₹4.65 lakh per household (79% cumulative increase)

The cumulative increase represents one of the sharpest expansions of sub-national debt among Indian states in recent years.

Borrowing-Fuelled Governance

Financial analysts note that the DMK government has relied heavily on borrowing to fund welfare schemes and subsidies, rather than significantly expanding revenue or reducing structural deficits. For 2025–26 alone, Tamil Nadu plans to borrow ₹1.62 lakh crore – an amount larger than the entire annual budgets of several smaller states.

While the 2025 budget projects that debt as a percentage of Gross State Domestic Product (GSDP) will gradually decline over the next few years, critics point out that these projections follow four consecutive years of aggressive borrowing that have already raised the absolute debt burden to record levels.

Subscribe to our channels on Telegram, WhatsApp, and Instagram and get the best stories of the day delivered to you personally.