When Prime Minister Narendra Modi held a video conference with the Chief Ministers of the states, he shared his thoughts that it would be pertinent on the parts of Chief Ministers of Maharashtra, Rajasthan, Telangana, West Bengal, Andhra Pradesh, Tamil Nadu and Kerala to reduce Value Added Tax (VAT) on petrol and diesel.

PM Modi said, “I request all states during the current global challenges, we should work as a team in line with the ethos of cooperative federalism.”

Central Govt’s Reduced Taxes On Its Part

As Diwali gift to the citizens of the nation, the Central Government reduced its excise duty on petrol & diesel by ₹5 and ₹10 respectively and he had appealed to the state governments to reduce VAT. All the BJP ruled states followed suit and reduced their components. Yes, states had to bear their share of loss. For instance, Gujarat and Kanataka had to forego a revenue of ₹4000 crores and ₹3000 crores respectively.

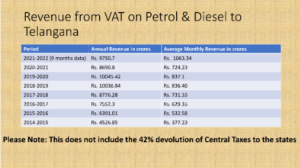

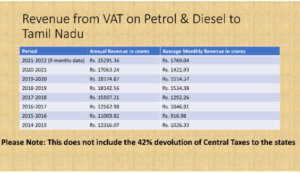

On the other hand, Maharashtra collected an excess of ₹3500 crores, Tamil Nadu earned ₹2400 crores and states like Telangana and AP earned over ₹1500 crores during the same duration.

The Prime Minister’s request has not gone down well with the opposition state CM’s like K. Chandrasekhar Rao, MK Stalin, Mamata Banerji and Uddhav Thackeray. Telanagana CM Chandrasekhar Rao said that the PM should feel ashamed for advising states to cut taxes. Similarly, as expected, Tamil Nadu CM MK Stalin made unwarraneted comments on the floor of the Assembly.

Breaking Down The Fuel Prices

Revenue earned by Central Government is less than ₹27.9 per litre on petrol and ₹21.8 per litre on diesel. If we calculate the 42% devolution of excise duty to states then the actual revenue per litre of petrol would be ₹22.6 and ₹21.22 per litre of diesel. (This calculation is arrived at keeping ₹12.4 for petrol and ₹9.8 for diesel as excise duty and reducing 42% as devolution to states.)

| Approximate Petrol and Diesel Price at Tamil Nadu | |||

| Petrol in Rupees | Diesel in Rupees | ||

| Crude Cost + Refinery Margins | 57.5 | 57.5 | |

| Central Government Tax | Basic Excise | 1.4 | 1.8 |

| Special Additional | 11 | 8 | |

| Agriculture Cess | 2.5 | 4 | |

| Road & Infra Cess | 13 | 8 | |

| Central Govt. Tax | 27.9 | 21.8 | |

| Central Government after 42% devolution | 22.6 | 21.22 | |

| Dealer Commission | 3.48 | 2.59 | |

| Freight | 0.2 | 0.33 | |

| TN Government Tax | Price Before VAT | 85.4 | 79.3 |

| 13% VAT | 11.1 | 8.72 | |

| Fixed Tax | 11.50 | 9.62 | |

| Total Tamil Nadu Government Tax | 22.60 | 18.34 | |

| Retail Selling Price per litre in Tamil Nadu | 111.68 | 100.56 | |

DMK Fails To Fulfil Its Promises

As indicated in the above table, it is clear that after reduction by Centre and BJP ruled state governments it is important for opposition ruled state to reduce the tax burden for people. People of Tamil Nadu must also remember the tall promises made in the DMK manifesto before elections that they would reduce ₹5 and ₹4 on petrol and diesel respectively once elected to power. They reduced only ₹3 on petrol and the Finance Minister of Tamil Nadu had the audacity to ask the media, “did we announce the date & time for reduction.” It is an altogether different matter that DMK has not bothered to fulfil many of its promises made in their manifesto like providing subsidy of ₹100 on LPG cylinder and giving ₹1000 for every woman in the household. These unfulfilled promises would haunt the Stalin Government soon.

Comparing Fuel Prices Of Different States

Apart from Tamil Nadu states like Rajasthan, Maharashtra and Telangana levy exorbitant VAT amounting to 31%, 26% & 35.2% which is resulting in high petrol and diesel prices. A cursory look at the prices across states would indicate the disparity in fuel prices in opposition ruled states as compared to that of BJP ruled states.

| State | Petrol | Diesel | Ruled |

| Mumbai (Maharashtra) | 120.51 | 104.77 | Opposition |

| Hyderabad (Telangana) | 119.49 | 105.99 | Opposition |

| Rajasthan | 118.30 | 100.92 | Opposition |

| Andhra Pradesh | 120 | 105.65 | Opposition |

| West Bengal | 115.12 | 99.83 | Opposition |

| Madhya Pradesh | 118.16 | 101.19 | BJP |

| Kerala | 115.37 | 102.26 | Opposition |

| Tamil Nadu | 111.68 | 101.41 | Opposition |

| Karnataka | 110.66 | 94.31 | BJP |

| Uttar Pradesh | 105.21 | 96.78 | BJP |

| Gujarat | 104.96 | 99.32 | BJP |

| Assam | 105.66 | 91.40 | BJP |

| Himachal Pradesh | 105.83 | 89.62 | BJP |

| Delhi | 105.41 | 96.67 | Opposition |

| Uttarakhand | 103.73 | 97.34 | BJP |

| Pondicherry | 104.65 | 93.02 | BJP |

This table clearly indicates the effect of reduction of state taxes in keeping the fuel rates low in the BJP ruled states but for the state of Madhya Pradesh. In fact, the impact of high diesel prices in opposition ruled states is clearly causing inflation in the economy since diesel rates impact the cost of food & vegetables. It is high time for the opposition ruled states to look at reducing the Value Added Tax (VAT).

No Value Addition By States But They Levy Value Added Tax

At this point in time it is paramount to ask the state governments on what is the value addition that states bring to fuel which allows them to add VAT. Since the procurement of crude is done by the central government, refining is done by companies and it is the oil marketing companies which fixes the prices and also appoints the retailer. Transportation is also not done by the state governments and hence it is time for the society to ask if charging as high as 35.2% VAT by state governments is justified without adding any value whatsoever.

The Governments of Telangana and Tamil Nadu have been making windfall of profits from the VAT collected from its citizens and it is absurd on their part to say that we should go back to the taxation followed by UPA regime.

The above two table clearly indicate that neither of the states have seen dip in their revenues from VAT but for the pandemic induced lockdowns which affected the revenue across the globe.

Going Back To 2014

A point raised by regional parties like DMK and TRS also deserves attention. Finance Minister of Tamil Nadu PTR and all-powerful Telangana Minister KTR keeps shouting that central government is depriving states by charging cess which does not come under the shared pool with the states. At the outset this argument looks fair but on a deeper analysis this argument is bereft of facts.

It was the government led by Narendra Modi which decided to charge the Agriculture cess and Infrastructure cess for several reasons. One of the primary reasons for Agriculture cess is the fact NDA Government is directly transferring ₹6000/- per annum to every farmer and these funds are used for the same.

On the other hand, while the infrastructure cess is not shared with the state governments it is the state governments which gets hugely benefited from the national highway projects for which the infra cess is utilised.

What PM Modi Has Done For Telangana

KTR has the habit of complaining against the Infra cess while it is the state of Telangana which got hugely benefited since 2015 from the Ministry of Road Transport and Highways (MORTH). Following are some of the benefits which the state of Telangana received:

- National Highways Project increased by 99% in Telangana after Modi became PM

- 2525 kms of state highways have been converted into National Highways (NH) by MORTH thereby making Telangana one of the best states in terms of connectivity. We also know the pain of commuting in a state highway and pleasure of commuting in NH

- Under the PM Gati Shakti 5 corridors costing ₹22,706 crores have been included as high impact projects in Telangana

- ₹31,624 crores of work have already been sanctioned for Telangana

- ₹32,755 crores worth Regional Ring Road (RRR) have already been sanctioned. It is a 6 lane 330-Kilometer-long road which connects Hyderabad with other districts

What The Dravidian Stockists Will Never Tell You

If these are few development projects for Telangana the state of Tamil Nadu has been rewarded with several projects and some of them are:

- Modi Government has already spent ₹28,846 crores on building highways in Tamil Nadu

- ₹91,750 crores are sanctioned of which ₹39,863 crores worth of projects are already awarded

- 8 state highways are being upgraded to National Highways

- ₹3000 crores worth East Coast Road (ECR) project is sanctioned

- Chennai Port-Maduravoyal double decker worth ₹5965 crores were sanctioned by National Highways Authority of India on October 2021 (It is to be noted that this project was proposed during UPA 2 Government & foundation stone was laid by Former PM Manmohan Singh in 2009 but was later abandoned)

- Under PM Gati Shakti program a new defence corridor is coming to Tamil Nadu

- Under Bharatmala Pariyojana a Multi Modal Logistics Park (MMLP) is being developed at Mappedu near Chennai in partnership with Chennai Port Trust and Govt of Tamil Nadu

- Bengaluru-Chennai expressway & Chennai-Salem expressway projects are approved

- Project in VOC Port worth ₹7500 crores are implemented under PM Gati Shakti

- $130 Billion (₹9,75,000 crores) worth investments are made under Sagarmala Program which would unlock the potential of waterways. Tamil Nadu would be the major beneficiary of this project

- Under Sagarmala Program 6 mega ports are being constructed across the country and out of the 6 mega ports 2 of them are from Tamil Nadu which are Sirkazhi (Techo Economic Feasibility Report is under preparation) and at Kanyakumari where a major transhipment port is being built. Special Purpose Vehicle (SPV) was formed for this purpose in March 2019

- In fact, of the 6 mega ports 2 are from Tamil Nadu and 1 each at West Bengal, Maharashtra, Odisha and Karnataka. This fact busts the fake news that Modi Government only favours BJP ruled states.

Conclusion

The Infrastructure Cess is being utilised to make India a powerful economic super power which is self-reliant and progress is happening across the country. Parties like DMK & TRS are making irresponsible and irrelevant statements to vent their frustrations and it is sad to see that these statements are emanating from so called educated ministers. National Highways are constructed by Central Government and hence there is no need to share the Infrastructure & Agriculture Cess with state governments.

While the Modi Government can say with 100% transparency on the investments made by using the cess can the opposition ruled state governments share the value addition that they are bringing to the citizens by charging exorbitant value added taxes and also on the utilisation of VAT in developing their states.

Instead of complaining the opposition ruled states must heed to the advice given by Prime Minister Narendra Modi by reducing the VAT and ease the burden of citizens.

Click here to subscribe to The Commune on Telegram and get the best stories of the day delivered to you personally.