Economists at the State Bank of India (SBI) in a report have stated that an increase in mobile transactions along with the number of bank branches, a careful recalibration of bank branches along a robust digital infrastructure has enhanced India’s financial inclusion metrics.

“India has stolen a march in financial inclusion with the initiation of Prime Minister Jan Dhan Yojana (PMJDY) accounts since 2014, using the banking correspondent (BC) model judiciously for furthering financial inclusion,” the report reads, as quoted by the Times of India (TOI).

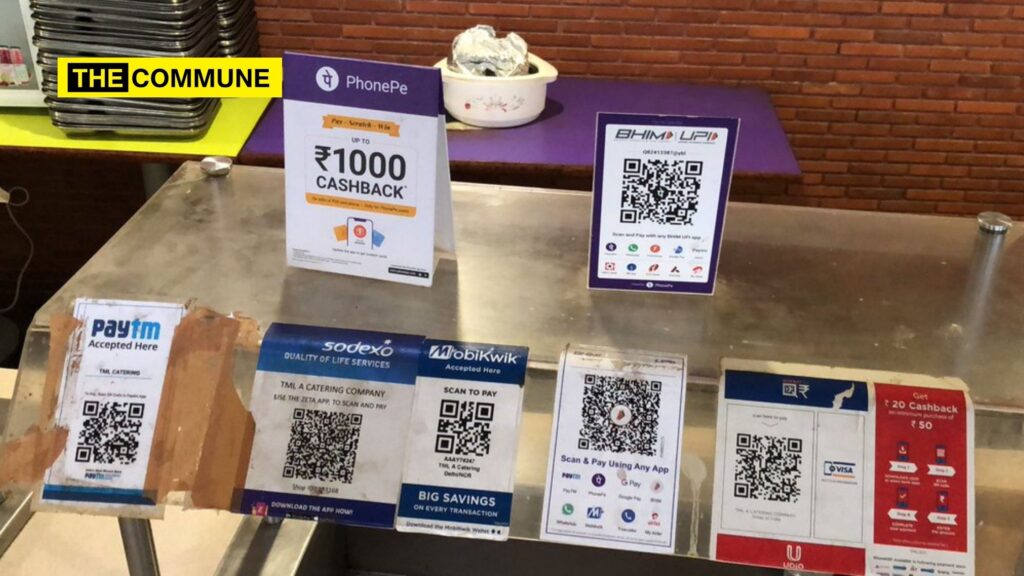

Mobile and internet banking transactions in India have risen to 13,615 per 1000 adults in 2020 from 183 back in 2015. Due to this many people made payments online or used their mobiles to make payment during the pandemic, thus reducing contact

Also, the number of bank branches has increased to 14.7 per 1 lakh adults as compared to 13.6 in 2015. India stands ahead of countries like China, Germany, and South Africa in these concerning financial inclusion metrics.

Moreover, the number of no-frills bank accounts opened in the last seven years has reached 43.7 crore with deposits worth Rs 1.46 lakh crore as of 20th October, and two-thirds of these accounts are operational in rural and semi-urban areas and a massive 78 per cent of these accounts are with state-owned banks.

Click here to subscribe to The Commune on Telegram and get the best stories of the day delivered to you personally.