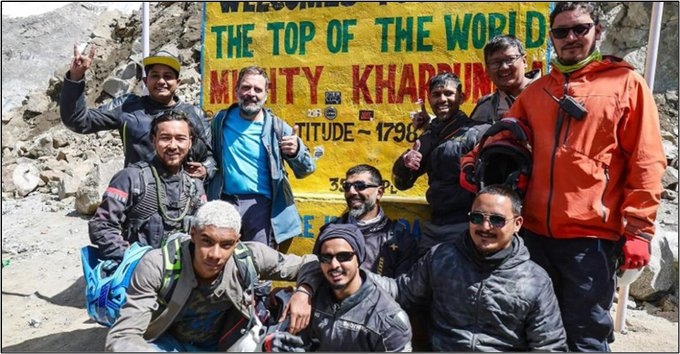

Remember August 2023 when Congress scion Rahul Gandhi made a bike trip to Ladakh?

Upwards and onwards – Unstoppable! pic.twitter.com/waZmOhv6dy

— Congress (@INCIndia) August 19, 2023

He reportedly rode to Pangong Tso lake, a strategically sensitive location to ‘celebrate‘ his father Rajiv Gandhi’s birth anniversary.

New details have surfaced regarding this visit, raising questions about the identity and background of one of the individuals who accompanied him to Pangong Tso, a sensitive area along the India–China border.

The individual at the centre of the controversy is Shakir Mohamed Nurali Merali, currently the Managing Partner for Africa at the global investment firm Lightrock.

An investigation into his professional history and the structure of his current firm reveals a trail linking him to the financial infrastructure of billionaire George Soros, to the scandal-ridden Pakistani firm The Abraaj Group, and to investment ventures backed by Chinese capital.

The Soros Connection: A Direct Line From SEDF To Lightrock

The foundation of the concerns lies in the origins of Shakir Merali’s current firm, Lightrock. Lightrock’s Indian platform was originally established as Aspada Investment Company, a venture wholly created and funded by the Soros Economic Development Fund (SEDF).

In 2019, the Liechtenstein-based LGT Group acquired Aspada from SEDF and rebranded it as Lightrock India.

Critically, the institutional relationship between Lightrock and the Soros network appears to have continued past the acquisition. Legal documents from 2021 confirm that Lightrock India and SEDF were co-investors in CapFloat Financial Services, indicating an ongoing partnership.

This connection gained renewed attention in March 2025 when the Enforcement Directorate (ED) conducted raids on locations linked to the Open Society Foundations and SEDF in Bengaluru over alleged foreign exchange violations.

The Abraaj Group Past: Pakistani Deals, Chinese Buyers, And Bribery Allegations

The Abraaj Group Past: Pakistani Deals, Chinese Buyers, And Bribery Allegations

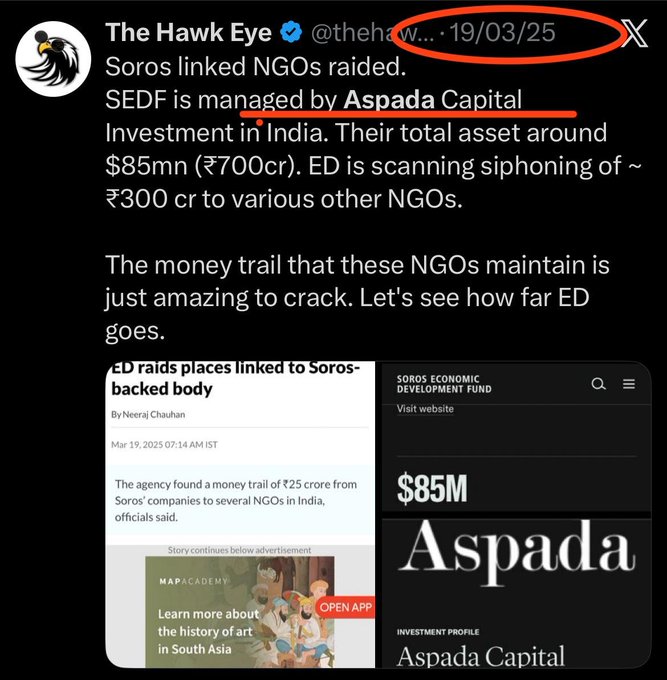

Prior to joining Lightrock, Shakir Merali served as a Managing Director at The Abraaj Group, a Dubai-based private equity firm founded by Pakistani businessman Arif Naqvi. Abraaj collapsed in 2018 following allegations of a massive fraud.

During Merali’s tenure, Abraaj was the majority owner (66.4%) of K-Electric, Pakistan’s largest power utility serving over 20 million people in Karachi.

During Merali’s tenure, Abraaj was the majority owner (66.4%) of K-Electric, Pakistan’s largest power utility serving over 20 million people in Karachi.

In 2016, Abraaj agreed to sell K-Electric to Shanghai Electric Power, a Chinese state-owned company, for $1.77 billion. This strategic deal, which would have placed critical Pakistani infrastructure under Beijing’s control, ultimately collapsed due to regulatory and geopolitical pressures.

A judicial commission in Pakistan later alleged that Abraaj had offered a $20 million bribery payment to then-Prime Minister Nawaz Sharif and his brother, Shehbaz Sharif, to push the deal through.

Furthermore, Arif Naqvi’s Abraaj was implicated in channeling foreign corporate money into Pakistani politics.

Furthermore, Arif Naqvi’s Abraaj was implicated in channeling foreign corporate money into Pakistani politics.

In March 2013, a Naqvi-controlled entity, Wootton Cricket Ltd, received $1.3 million from Abraaj Investment Management. On the same day, an identical amount was transferred to the bank account of Imran Khan’s Pakistan Tehreek-e-Insaf (PTI) party.

Shakir Merali, as a senior Managing Director at Abraaj with responsibilities for the East Africa portfolio and the Africa Health Fund, operated within this institutional culture, which included pursuing major Chinese state acquisitions and navigating allegations of bribery and political finance violations.

African Investments And Chinese Capital Overlaps

Merali’s current investment focus at Lightrock, Africa, frequently intersects with zones of heavy Chinese state enterprise activity. For instance, in 2018, Kenya’s KETRACO signed a $240 million contract with China Electric Power Equipment for railway electrification.

Separately, Merali is a personal angel investor in Ilara Health, a Nairobi-based health-tech startup that is backed by the Chinese venture capital fund ShakaVC.

The Pangong Tso Meeting: A Convergence of Controversies

The convergence of these associations, ongoing Soros network ties, a direct past in a firm that attempted to sell vital Pakistani assets to a Chinese state entity, and current investments alongside Chinese capital, makes the location of his meeting with Rahul Gandhi particularly alarming to security experts.

Pangong Tso is not a tourist destination. It is a live border flashpoint where Indian and Chinese troops have been in a protracted standoff since 2020. The area is one of the most militarily sensitive zones in the country.

Pangong Tso is not a tourist destination. It is a live border flashpoint where Indian and Chinese troops have been in a protracted standoff since 2020. The area is one of the most militarily sensitive zones in the country.

The presence of a foreign executive with this specific multi-layered background at this location, as a guest of a senior opposition leader, has raised a storm of questions in strategic circles. Analysts are demanding to know the purpose of the meeting, who approved the visit, and what was discussed against the backdrop of the lake, which is synonymous with the ongoing Sino-Indian border crisis.

(This article is based on an X Thread By The Hawkeye X)

Subscribe to our channels on WhatsApp, Telegram, Instagram and YouTube to get the best stories of the day delivered to you personally.