Congress leader Rahul Gandhi came under fire on Thursday after endorsing former US President Donald Trump’s controversial statement calling India a “dead economy.” Gandhi, speaking to reporters outside Parliament, said Trump was “right” and claimed, “everyone knows this except the Prime Minister and Finance Minister.”

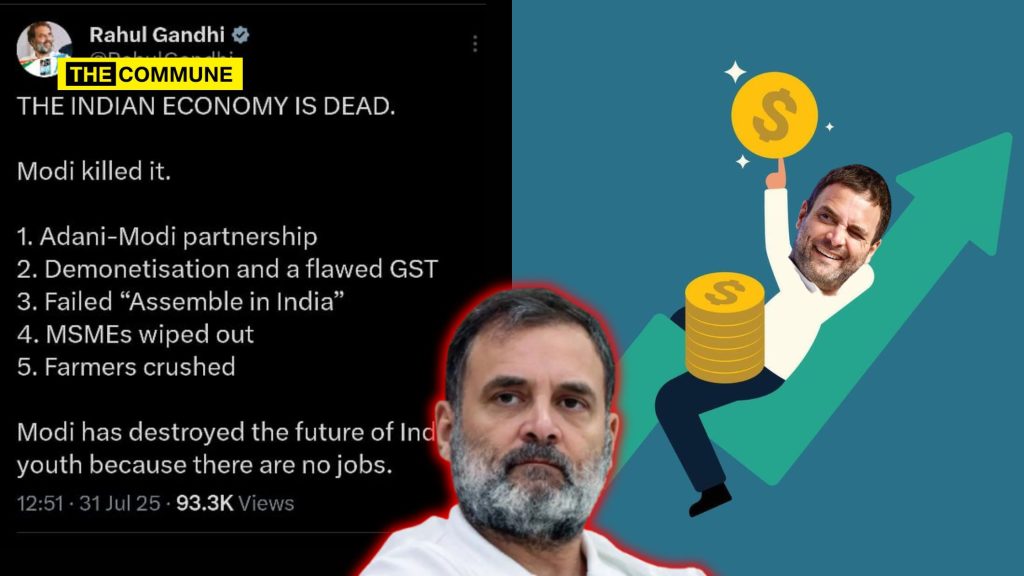

THE INDIAN ECONOMY IS DEAD.

Modi killed it.

1. Adani-Modi partnership

2. Demonetisation and a flawed GST

3. Failed “Assemble in India”

4. MSMEs wiped out

5. Farmers crushedModi has destroyed the future of India’s youth because there are no jobs.

— Rahul Gandhi (@RahulGandhi) July 31, 2025

The comment sparked a political backlash, with BJP leaders accusing Gandhi of echoing foreign criticism for political gains, even as his own financial disclosures paint a very different picture of economic performance.

Just about a year earlier, in his affidavit submitted to the Election Commission ahead of the 2024 Lok Sabha elections, Gandhi declared personal assets exceeding ₹20 crore. His affidavit revealed that over 90% of his movable wealth, ₹8.16 crore, was invested in mutual funds and stocks, sectors that have witnessed robust growth over the past year.

Gandhi’s stock portfolio, worth more than ₹4.33 crore as of March 15, 2024, spans 25 listed companies. His largest stock holding was in Pidilite Industries (₹42.27 lakh), followed by blue-chip firms like Bajaj Finance (₹35.89 lakh), Nestlé India (₹35.67 lakh), and Asian Paints (₹35.29 lakh). Other holdings included ITC, ICICI Bank, Infosys, TCS, Deepak Nitrite, and Divi’s Laboratories – stocks that have consistently delivered high returns in a growing market.

He also held mutual fund investments worth ₹3.81 crore across seven schemes, with his largest being in HDFC Small Cap Fund (₹1.23 crore), which delivered a 51.85% return in the past year. He further held sovereign gold bonds worth ₹15.21 lakh, a Public Provident Fund with ₹61.52 lakh, and immovable assets totalling ₹11.15 crore.

As per his own affidavit @RahulGandhi has invested Rs 8.32 crores in a dead Economy. Either he is dumb to do so or a liar as the economy is NOT Dead. Can @INCIndia @SupriyaShrinate @Jairam_Ramesh throw some light. pic.twitter.com/oOn0elNK6F

— Maj Gen Harsha Kakar (@kakar_harsha) July 31, 2025

Trump’s original remarks, made on Truth Social after announcing 25% tariffs on Indian imports, targeted both India and Russia, saying he didn’t care about their economic partnership as both had “dead economies.”

Gandhi seized on the statement to attack Prime Minister Narendra Modi, blaming demonetisation and a flawed GST regime for economic distress. “MSMEs have been wiped out, farmers are crushed, and ‘Assemble in India’ has failed,” he claimed.

However, critics argue that Gandhi’s personal financial growth contradicts his narrative. With a diverse, high-performing portfolio benefiting from India’s capital markets, his financial disclosures appear at odds with his political messaging.

While Gandhi’s remarks might have intended to underline challenges in the economy, they have instead highlighted the growing chasm between rhetoric and reality, particularly for a leader whose investments have thrived within the same system he now condemns.

(With inputs from India Today)

Subscribe to our channels on Telegram, WhatsApp, and Instagram and get the best stories of the day delivered to you personally.