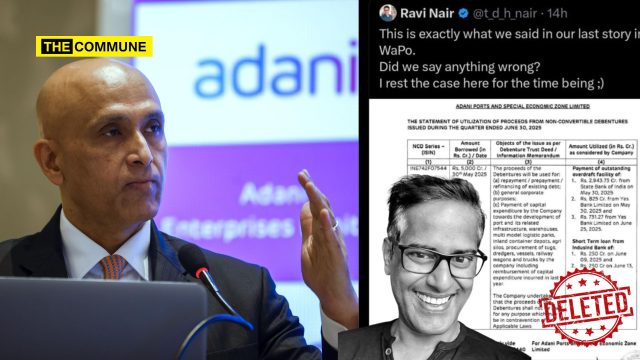

Self-proclaimed “independent investigative journalist” or more like leftist-funded propagandist Ravi Nair wrote a post on 6 November 2025 on his X handle, that misrepresented Adani Ports and Special Economic Zone Limited’s (APSEZ) financial disclosures. Nair claimed that the company’s ₹5,000 crore non-convertible debenture (NCD) issue involved opaque related-party transactions, citing excerpts from a May 2025 regulatory filing.

After backlash, he deleted the post.

What Actually Happened?

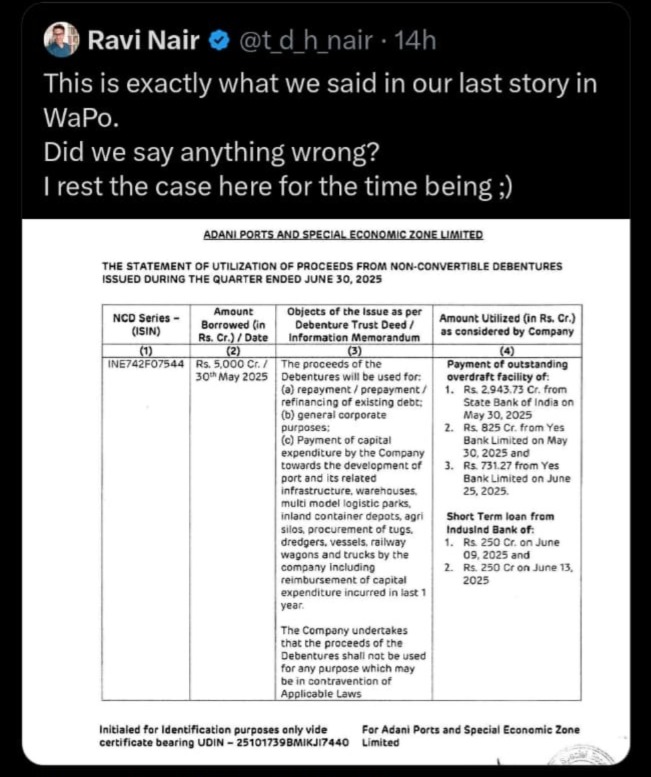

The controversy began when Nair posted a screenshot of a financial document from Adani Ports and Special Economic Zone Limited, along with the comment, “This is exactly what we said in our last story in WaPo. Did we say anything wrong? I rest the case here for the time being ;)”

The document in question was a statutory filing detailing the utilization of proceeds from a ₹5,000 crore Non-Convertible Debenture (NCD) issue. Nair’s implication was that the company had acted opaquely, using the newly raised funds simply to repay other loans from banks like State Bank of India and Yes Bank.

The table, however, showed that the NCD proceeds were utilized for standard debt refinancing and short-term loan repayments including ₹2,943.73 crore to State Bank of India and ₹1,546 crore to Yes Bank in May and June 2025 – all in compliance with the stated purpose outlined in the company’s official documents.

Adani Group CFO Response

The narrative was swiftly challenged by Adani Group Chief Financial Officer, Jugeshinder Singh. Singh clarified that the use of funds for “repayment/refinancing of existing debt” was not only explicitly listed as a primary objective in the very document Nair cited but was also a standard and legitimate corporate financial practice aimed at managing debt maturity profiles.

This is why @t_d_h_nair is a proud member of “Modern day Moron” club. What he is not telling you is this:https://t.co/iT75lkvMc9

If you ever took commerce stream in 10+2 system (ie grade 11 in school), you woudl know. Ravi does not understand elementary cash management. That… https://t.co/6fF2rdDzDH

— Jugeshinder Robbie Singh (@jugeshinder) November 6, 2025

Faced with this factual rebuttal, Nair silently deleted the tweet. He has not issued a public correction or apology for the initial post.

A Lesson in Corporate Finance

Financial experts explain that the document Nair shared clearly outlined three permissible uses for the funds: (a) debt repayment/refinancing, (b) general corporate purposes, and (c) capital expenditure. By using the funds to repay shorter-term bank facilities, Adani Ports was operating squarely within the legally disclosed parameters—a common strategy for companies seeking to extend debt maturities or optimize their capital structure.

Netizen Response

Netizens trashed Nair’s understanding of economics, numbers, finance and called out his lack of understanding of basic 11th standard commerce.

Ravi Nair ko balance sheet de do, woh scandal bana dega.@washingtonpost ko de do, woh “global exposé” likh dega.

Ignorance ka global supply chain ready hai. https://t.co/4QEQQky8Z1 pic.twitter.com/4kwkrWOi2C

— Facts (@BefittingFacts) November 6, 2025

Imagine failing 11th-grade commerce, then waking up one day and writing opinion pieces on global finance.

That’s Ravi Nair. And Washington Post, they called it journalism 😂😂 https://t.co/eHQynk39eL— Rosy (@rose_k01) November 6, 2025

Finance ka gyaan Ravi Nair se lena is like learning driving from a guy who’s never seen a steering wheel.@washingtonpost publishes his confusion like it’s gospel truth. https://t.co/YT0vr7NZkD pic.twitter.com/zb6qaEmyuU

— News Algebra (@NewsAlgebraIND) November 6, 2025

“Ravi Nair reads a financial statement like a chef reads a circuit diagram, zero clue, full confidence,” quipped one user, summarizing the sentiment of many.

Ravi Nair reads a financial statement like a chef reads a circuit diagram, zero clue, full confidence.

And @WashingtonPost happily prints it as ‘investigative journalism.’😂And he deleted the tweet when called for. Together, they’ve turned ignorance into an editorial policy https://t.co/UNCc3oQqEe

— The Analyzer (News Updates🗞️) (@Indian_Analyzer) November 6, 2025

Nair & Adani – Not The First Time

This is not the first time that Nair has targeted the Adani group. In October 2025, Nair published a propaganda piece in Washington Post claiming a ₹33,000 crore ($3.9 billion) LIC “bailout” for the Adani Group has drawn sharp criticism in India for alleged factual distortion and bias. LIC and government officials dismissed the claim as baseless, clarifying that the transaction was a routine, AAA-rated bond subscription within regulatory norms.

Former LIC chairman Siddhartha Mohanty called the story a “misleading narrative,” noting LIC’s independent decision-making and strong financials, including ₹48,151 crore profit in FY 2024–25. Critics argued the report reflects a recurring anti-India pattern in The Washington Post’s coverage, noting that all its 2024 Pulitzer finalists centered on negative portrayals of India. Reporter Pranshu Verma, who co-authored those stories, also wrote the Adani-LIC piece.

Observers saw such narratives as geopolitically motivated attempts to undermine India’s economic rise.

Nair has faced multiple defamation suits for earlier pieces in The Guardian, Frontline, and The Wire, accused of recycling debunked claims and amplifying foreign-funded anti-India narratives linked to groups like OCCRP and Hindenburg. Critics say his work aligns with Western short-sellers and political actors seeking to damage India’s economic reputation. From false EVM claims to sensationalized Adani “exposés,” Nair has become emblematic of what many describe as propaganda journalism – reckless, inaccurate, and driven by ideology rather than fact.

Subscribe to our channels on WhatsApp, Telegram, Instagram and YouTube to get the best stories of the day delivered to you personally.