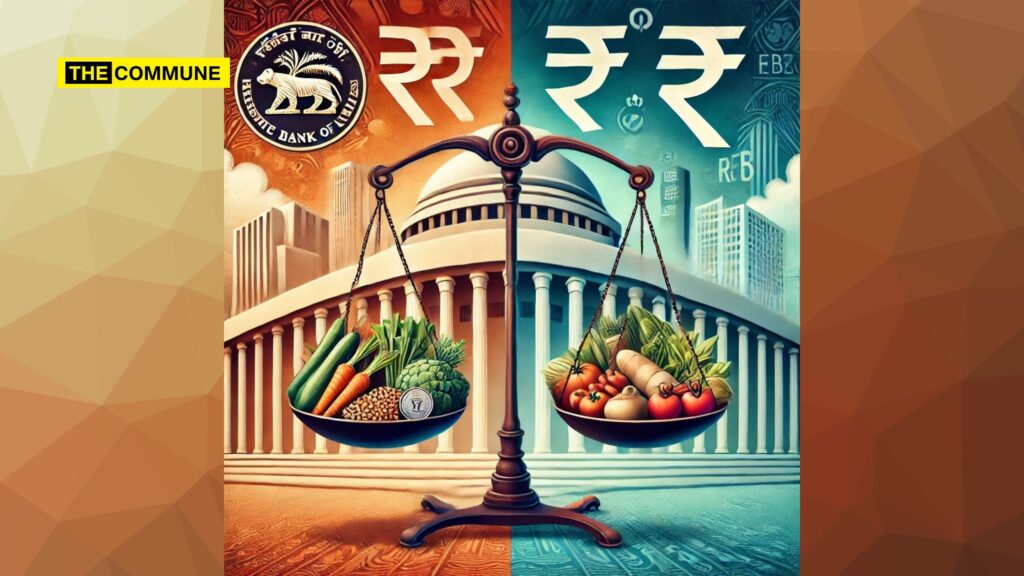

The Reserve Bank of India’s approach to inflation management emphasizes maintaining high interest rates to anchor inflationary expectations, citing high food prices as a key factor. However, monetary policy primarily impacts core inflation, which excludes food and fuel, and is already under control. The current inflation-targeting framework, introduced in 2016, uses the Consumer Price Index (CPI), where food prices hold a 45% weight, as its sole reference point.

Recently, there has been much debate about the efficacy of current monetary policies and their impact on inflation, particularly food prices.

RBI’s Approach

RBI’s hawkish decision (to hold rates despite growth slowdown fears) and subsequent statements have led to an underlying sentiment that RBI is overly cautious when it comes to adjusting interest rates, often citing high food prices as a reason to delay rate cuts. This has led to frustration among observers who argue that food prices are not particularly sensitive to interest rates and that monetary policy cannot effectively control them.

It’s well-known that core inflation (which excludes food and fuel prices) is more sensitive to interest rates. Despite this, the RBI maintains high rates to anchor inflationary expectations, which many see as likely to lower core inflation to unhealthy levels just to keep the headline inflation within the prescribed band.

The Finance Ministry’s Role

The Finance Ministry set the inflation target at 4% with a margin of ±2% and agreed to use the Consumer Price Index (CPI) as the sole reference index in 2016. With food prices making up about 45% of the CPI, this decision has led to fears that it overemphasizes food inflation in overall monetary policy decisions.

When this framework was up for review in 2021, there were expectations that the government might revise the methodology to give some weight to core inflation or the Wholesale Price Index (WPI). Surprisingly, the Finance Ministry chose to continue with the same practice, a decision that has now come back to bite them. This has perpetuated a framework that many believe is flawed. Now even the Chief Economic Advisor has called for excluding food prices from the inflation gauge to be used for making monetary policy decisions. Therefore, we need not just a pragmatic decision by the RBI on interest rates in the near future but also a balanced approach by both the govt and the RBI on the overall inflation-targeting mechanism over the next 2 years.

Rather than viewing recent comments of the Honorable FM regarding interest rates as criticism, it is time the Finance Ministry and RBI sit together and review the policy framework from 2016.

An article published on this topic did not give the impression that FM had expressed any opinion on rate cuts, much less apply pressure on RBI. RBI fussing over vegetable pieces and using them to postpone rate cuts is deplorable but not unexpected. Over the years, I have started believing that economists are a bunch of people who find some excuse or other to keep complaining about inflation and holding the rates high for as long as possible. Even a 12th-grade economics student knows that food prices are not sensitive to interest rates and monetary policy cannot affect them. But still, they keep the rates high even though the core inflation (inflation minus food and fuel) which is sensitive to interest rates is well under control. When confronted with questions about the efficacy of high rates in tackling food inflation.

Srinilaya Swamy is a retired CFO and Company Secretary.

Subscribe to our channels on Telegram, WhatsApp, and Instagram and get the best stories of the day delivered to you personally.