Tamil Nadu has emerged as a significant story in India’s economic landscape, recently recording a headline-grabbing 16% growth in its Gross State Domestic Product (GSDP) at current prices for 2024-25. Chief Minister MK Stalin has attributed this success to the “Dravidian Model” of governance. This article delves into the data, trends, and drivers behind this growth, providing a comprehensive analysis based on official reports and economic surveys.

The Growth Claim: Is Tamil Nadu The Leader?

According to RBI data released in December 2025, Tamil Nadu’s economy expanded from ₹27 trillion to ₹31 trillion at current prices, marking the highest growth rate among major states for the year, with Gujarat being a notable exception in the update. In real terms (constant 2011-12 prices), the growth is an impressive 11%, again leading the pack.

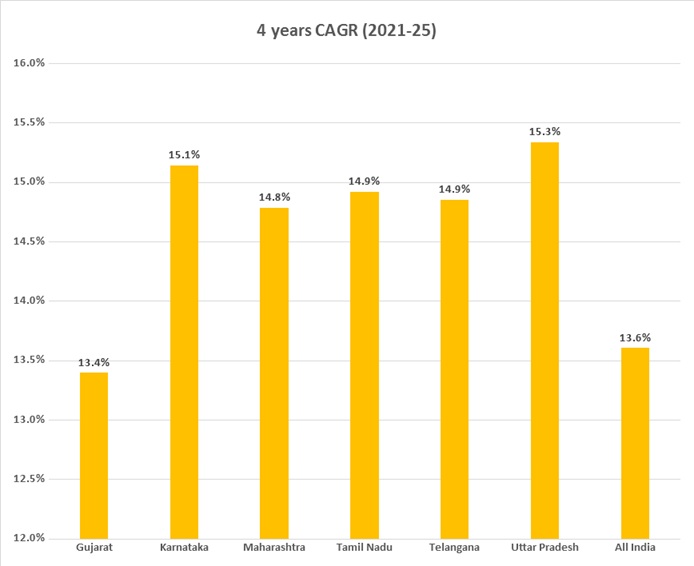

However, a broader view reveals a more nuanced picture. When examining the cumulative period since the DMK government took office in 2021, Tamil Nadu’s Compound Annual Growth Rate (CAGR) at current prices is a healthy 14.9%. Yet, it trails behind Uttar Pradesh (15.3%) and Karnataka (15.1%).

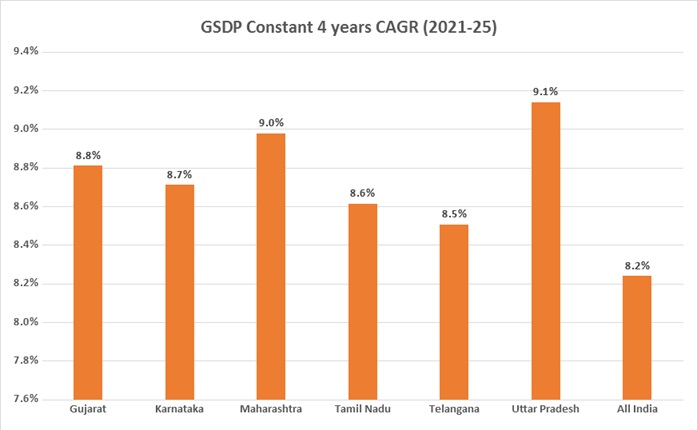

In constant price terms, TN’s CAGR for this period is 8.6%, placing it behind leaders like Uttar Pradesh (9.1%), Maharashtra (9%), Gujarat (8.8%), and Karnataka (8.7%).

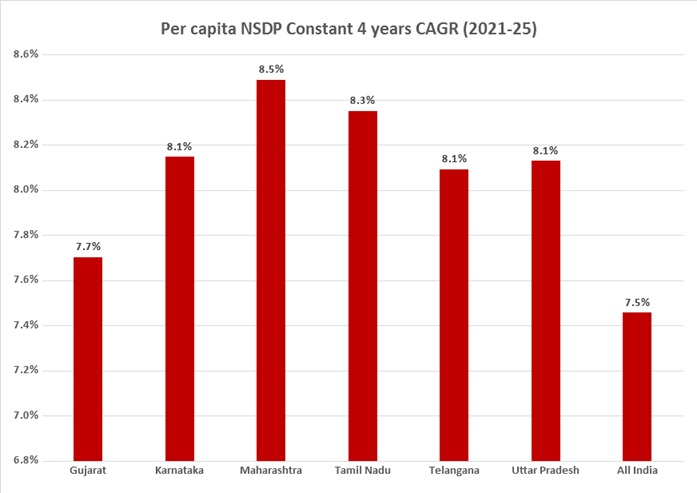

In per capita income growth (constant prices), Tamil Nadu’s 8.3% CAGR is just below Maharashtra’s leading 8.5%.

Growth Trends Under The DMK Regime

The growth trajectory over the past four years shows a distinct pattern. The first two years of the DMK government (2021-23) saw modest GSDP growth in real terms, hovering around 6-8%. A significant acceleration began in 2023-24, culminating in the 11.2% growth for 2024-25. This uptick coincided with a national manufacturing upswing and the full-scale takeoff of the Central Government’s Production-Linked Incentive (PLI) schemes.

While Tamil Nadu’s growth has outperformed other major states in the last two years, the four-year CAGR still shows it catching up from a slower start, as illustrated in the provided charts.

The Engines Of Growth: Key Sectors

The surge is primarily powered by a few high-performing sectors. Analysis of Net State Value Added (NSVA) at constant prices highlights Real Estate Services and Manufacturing as the top contributors, followed by Trade and Repair Services.

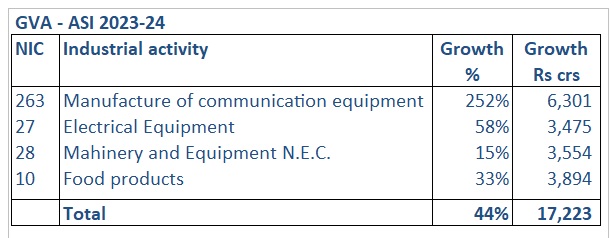

Manufacturing: Within manufacturing, Annual Survey of Industries (ASI) data points to explosive growth in subsectors like communication equipment, electrical equipment, machinery, and food products.

Services: The services sector boom is largely driven by IT and IT-enabled services, alongside increased urbanization, as noted in the Tamil Nadu Economic Survey.

The Centre Vs. State Debate: Who Fuels The Growth?

Chief Minister Stalin has frequently stated that Tamil Nadu’s success comes “despite not receiving adequate support from the Centre.” The data, however, suggests a more collaborative reality.

The Tamil Nadu government has allocated a substantial ₹2,900 crores for industrial promotion over 2023-25. On a much larger scale, the Central Government’s PLI scheme, with a total outlay of ₹1.97 lakh crores across 14 sectors, has been a critical catalyst.

Union Finance Minister Nirmala Sitharaman has stated that 25% of companies availing PLI benefits are from Tamil Nadu, particularly in electronics, electronic components, and automobiles, making the state the scheme’s largest beneficiary.

The state’s Industries Minister has also acknowledged that the dramatic rise in electronics exports over the last two years is directly linked to the PLI scheme.

ASI data for 2023-24 shows that nearly ₹17,000 crores in Gross Value Added (GVA) came from manufacturing sectors like communication equipment and food products, which are directly aligned with PLI incentives.

While PLI-driven manufacturing has been central, growth in Software Exports, Real Estate, and Construction also reflects the state’s own policy environment and economic dynamism.

The Road Ahead: Can The Momentum Be Sustained?

The outlook for Tamil Nadu’s economy remains positive in the near term. Growth is expected to be sustained by the ongoing momentum in PLI-linked industries, robust software exports, and an active construction sector.

For long-term resilience, experts recommend:

Enhanced Centre-State Partnership: Deepening collaboration on PLI schemes and developing industrial corridors.

Sectoral Integration: A NITI Aayog report suggests deeper integration of IT-enabled services within traditional manufacturing clusters like Coimbatore, Hosur, and Tiruppur.

MSME Linkages: Connecting specialized service MSMEs with industrial parks and freight corridors to create a more integrated economic ecosystem.

Conclusion

Tamil Nadu’s economic story is one of remarkable resurgence, particularly in the last two years. While the state government rightly celebrates the success of its “Dravidian Model” in fostering a conducive business environment, the data highlights a significant synergy between state initiatives and central policy, especially the transformative PLI scheme. The challenge and opportunity now lie in leveraging this growth phase to build a more diversified, innovative, and integrated economy that ensures broad-based prosperity for its citizens.

Baskar is a finance professional having keen interest in current affairs and Indian culture.

Subscribe to our channels on Telegram, WhatsApp, and Instagram and get the best stories of the day delivered to you personally.