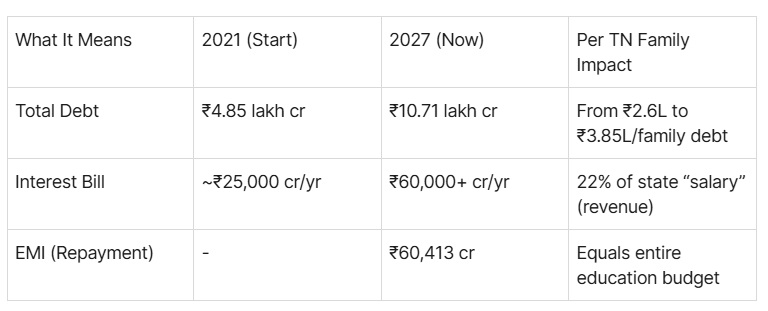

Tamil Nadu’s public debt has surged dramatically under DMK rule, rising from ₹4.85 lakh crore in March 2021 to a projected ₹10.71 lakh crore by March 2027 – a staggering 121% increase in just six years.

When DMK assumed office in May 2021, they inherited a debt of ₹4,85,502 crore from the previous AIADMK regime. Today’s interim budget reveals outstanding liabilities will cross ₹10 lakh crore by FY27-end, adding ₹5.86 lakh crore during their tenure. While government claims this growth (121%) is lower than AIADMK’s 128% (2016-21), the absolute quantum is unprecedented, raising legitimate concerns about fiscal sustainability despite debt/GSDP ratios holding at 26-28%.

Total DMK-era addition: ₹5.86 lakh crore over 6 years (2021-27)

What Drove This Explosion?

#1 Post-COVID Emergency Spending (2021-23)

Inherited ₹4.85 lakh crore amid second wave

Immediate welfare: ₹1,000/month to women (Kalaignar scheme), free bus travel

MGNREGA top-ups, health infrastructure

Revenue shortfall forced market borrowings when Centre withheld GST compensation

#2 Infrastructure Acceleration (2023-25)

A sharp jump in borrowing around FY25 is linked to big-ticket infrastructure like Chennai Metro Phase-II (₹9,523 crore booked under state debt), major road upgrades, industrial corridors and power projects.

#3 Centre-State Fiscal Tensions

Borrowing ceiling caps (3.5% GSDP) force off-budget liabilities

The state plans to repay ₹60,413 crore of debt in 2026–27, while also carrying a large interest bill that eats significantly into revenue receipts.

The government alleges large pending dues from the Centre (running into over ₹1 lakh crore), which it says forced higher borrowing; this remains a contested political point.

Government Defense vs. Critics

DMK Position:

- Debt/GSDP stable at 26.35% (within 15th Finance Commission 28% limit)

- “Inherited fiscal mess; Centre clipping wings”

- Compared favorably to AIADMK’s 128% debt growth

GSDP has risen from about ₹21 lakh crore in 2020–21 to over ₹31 lakh crore in 2024-25 and is projected to keep growing towards the ₹40 lakh crore mark by 2027.

Opposition Critique:

- Absolute rise largest in state history

- Welfare populism over productive investment

- Interest payments crowding out development spending

Based on the state’s own 2021 estimate of about ₹2.64 lakh debt per family, the projected ₹10.71 lakh crore by 2027 would imply roughly ₹3.8–3.9 lakh per family.

Fiscal Math: Sustainable or Alarming?

Debt around March 2021 (pre‑DMK): ≈ ₹4.85 lakh crore.

Projected debt March 2027: ₹10.71 lakh crore. That’s a rise of about 121% (4.85 → 10.71).

2020‑21 GSDP (BE) was about ₹20.9 lakh crore.

2024‑25 RE and 2025‑26 BE GSDP are given (e.g., ₹31.19 lakh crore for 2024‑25; ₹35.68 lakh crore projected for 2025‑26).

Growth rates at current prices are reported as 15.9%, 14.4%, 13.3%, 16% for 2021‑22 to 2024‑25.

Tamil Nadu’s GSDP has grown in double digits each year (about 14–16% annually at current prices in recent years), reaching around ₹31.19 lakh crore in 2024‑25 and ₹35.68 lakh crore projected for 2025‑26, with further growth projected up to 2027.

This combination explains why the debt‑to‑GSDP ratio sits in the 26–28% band, even though the absolute debt stock has more than doubled.

Debt growth outpacing the economy slightly means Tamil Nadu is borrowing a bit faster than its income grows, keeping the debt ratio steady but making repayments tougher for taxpayers.

Simple Analogy: Household Budget

Imagine your income roughly doubles over six years while your debt also more than doubles. The ratio looks similar, but your absolute EMI and interest load become much heavier.

Good news: Debt is still ~25% of income (manageable ratio).

Warning signs:

- ₹1.3 lakh yearly interest eats 22% of salary

- ₹60,000 monthly EMIs strain cashflow

Sustainable? Yes, if income keeps rising 12% yearly.

Alarming? If recession hits or rates jump, even at “stable” ratios, families can’t ignore the absolute pile-up.

The Bottom Line

DMK inherited ₹4.85 lakh crore in March 2021 from the ADMK, a sum that the state took 7 decades to build up. This debt has more than doubled to ₹10.71 lakh crore in the present DMK regime. While ratios remain “manageable,” the absolute trajectory, fueled by welfare promises, infrastructure ambitions, and Centre-state friction, demands urgent fiscal discipline. With elections looming, today’s interim budget signals continuity rather than course correction, leaving ₹10.71 lakh crore as DMK’s fiscal legacy by March 2027.

Subscribe to our channels on WhatsApp, Telegram, Instagram and YouTube to get the best stories of the day delivered to you personally.