The 2024–2025 Annual Report of Tamil Nadu Power Distribution Corporation Ltd (TNPDCL), formerly TANGEDCO, has drawn attention for its depiction of the utility’s fragile financial position, with disclosures indicating structural stress, heavy indebtedness, and continued reliance on government backing.

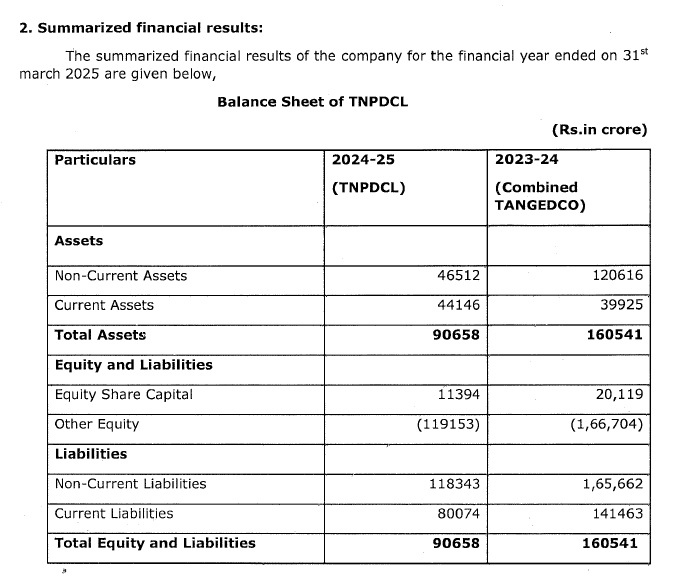

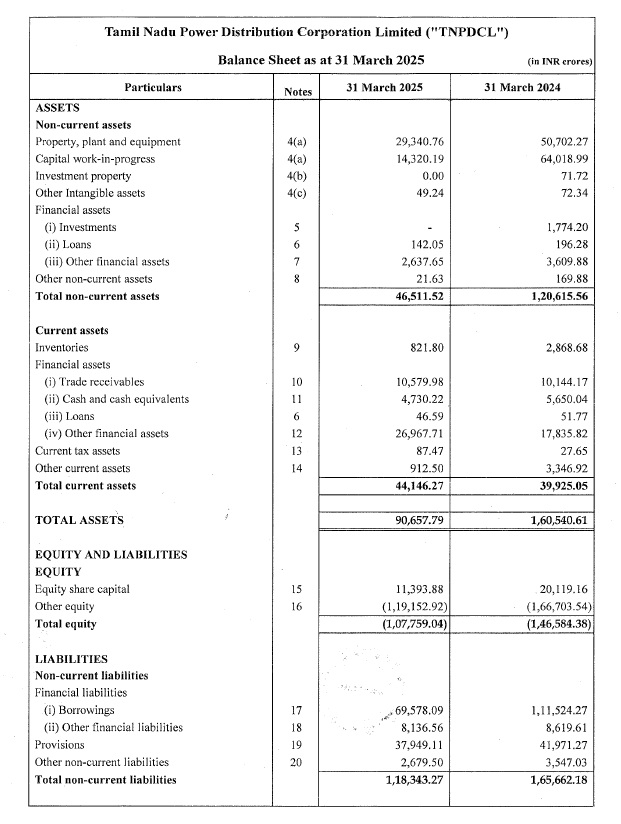

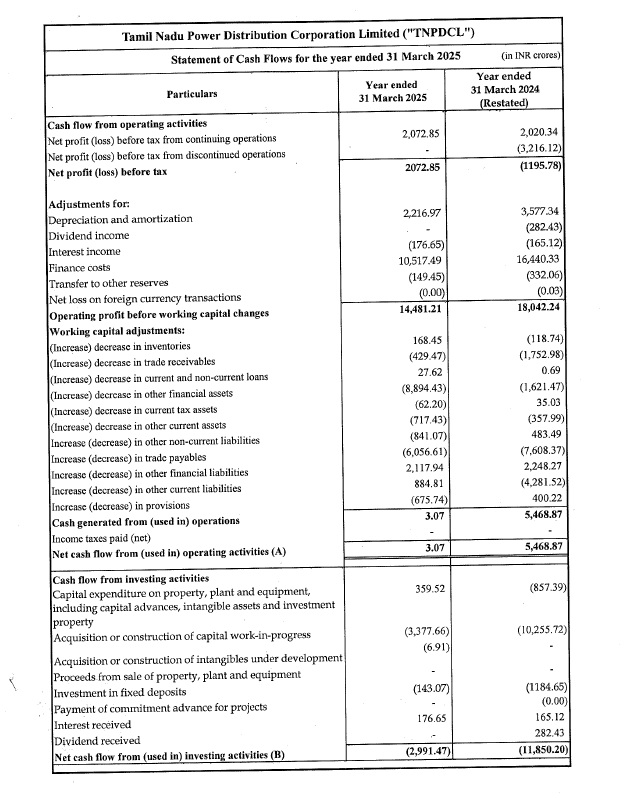

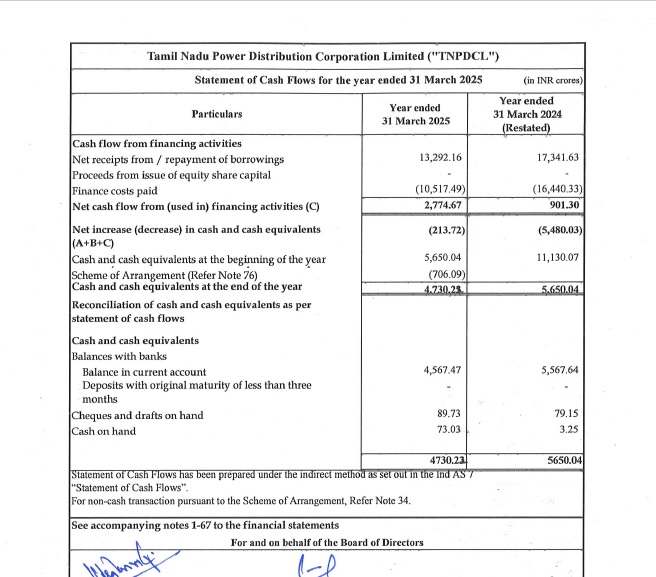

Financial statements in the report point to a deeply strained balance sheet, with liabilities significantly outweighing assets and the corporation carrying a negative net worth exceeding ₹1 lakh crore. The utility’s operations appear sustained through a combination of state support and large-scale borrowings.

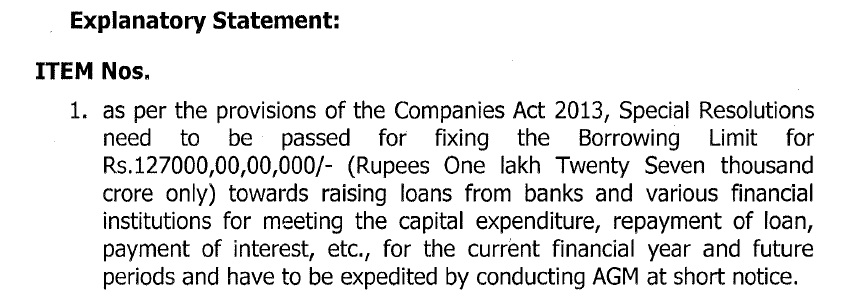

The report also records moves to expand borrowing capacity, with shareholder approval sought to raise borrowing limits up to ₹1.27 lakh crore, underscoring the scale of debt dependence required to sustain power distribution operations in the state.

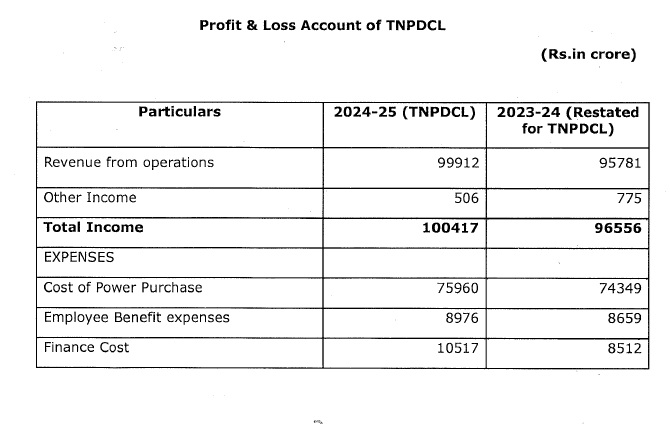

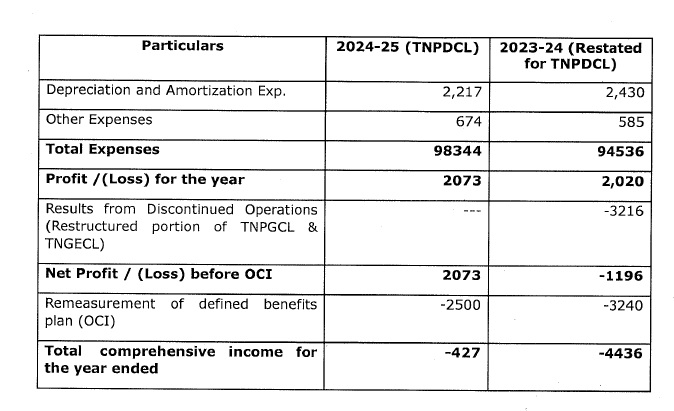

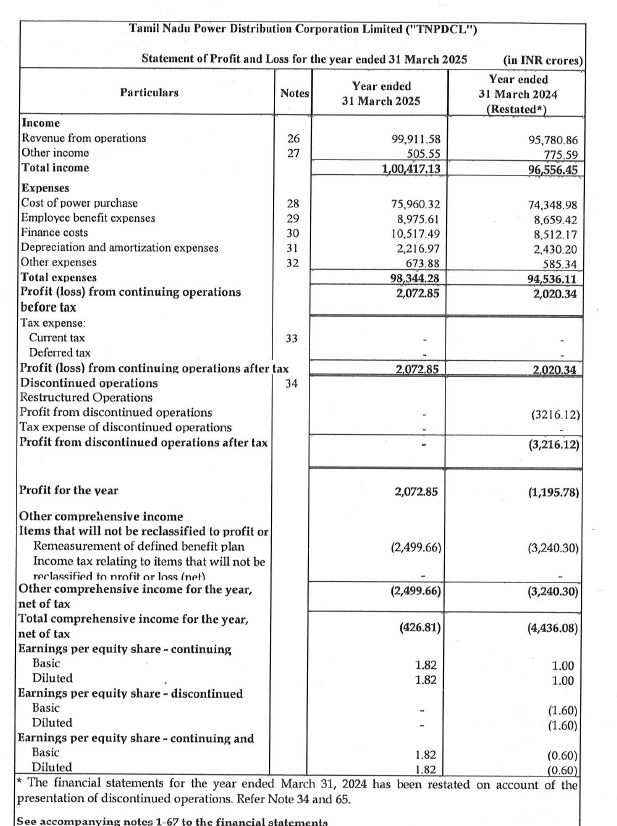

While TNPDCL has reported an operational profit for the financial year, the broader financial disclosures, including accumulated losses, liabilities, and financing costs, indicate continuing structural insolvency pressures despite accounting surpluses.

Attention has also turned to the financing chain linked to the power utility. Tamil Nadu Power Finance & Infrastructure Development Corporation Ltd (TNPFIDC), a state-owned non-banking financial company, functions as a key lender to power and infrastructure entities, including TNPDCL/TANGEDCO, by mobilising institutional deposits and market borrowings.

In this context, concerns have been raised regarding the investment of temple-linked funds in TNPFIDC. Available material indicates that large sums belonging to Hindu religious institutions have been deposited in the NBFC, which carries a BBB- credit rating – the lowest rung within investment-grade classifications.

The exposure has drawn scrutiny due to the financial stress in the downstream power sector entities to which TNPFIDC lends, raising questions about risk concentration and fiduciary prudence in the deployment of religious endowment funds.

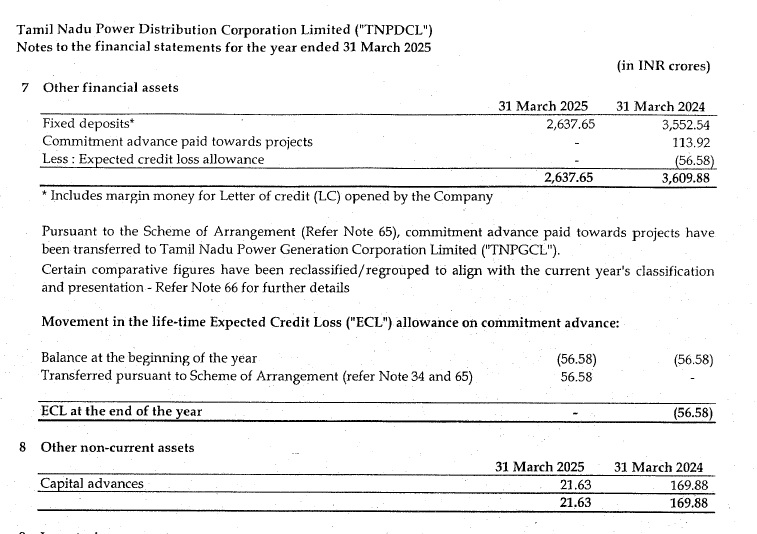

Estimates circulating in public discourse place temple fund exposure to TNPFIDC at around ₹2,700 crore. However, a detailed audited breakdown of temple-wise deposits within the NBFC’s financial statements is not publicly enumerated in the material reviewed.

I went through the 2024-2025 Annual Report of Tamil Nadu Power Distribution Corporation Ltd (TNPDCL) – formerly known as TANGEDCO –

The contents of the Report were shocking. The observations made by the Auditors regarding the financial position of the company were quite… pic.twitter.com/MHjx8vjlB8

— trramesh (@trramesh) February 5, 2026

Subscribe to our channels on Telegram, WhatsApp, and Instagram and get the best stories of the day delivered to you personally.