Debates around Centre–State finances frequently surface in the public domain, often framed as political flashpoints rather than fiscal questions grounded in data. Neutral and comprehensive explanations remain rare, with narratives typically shaped by partisan positions. This article attempts to bridge that gap by laying out the complete context and relevant data, enabling readers to assess the issue beyond the rhetoric.

Background

India is a large and diverse developing country and is the largest democratic federal republic. The country has a three-tier federal structure with governments at Union, States and Local levels. The Union list of Constitution gives power to the Central Government to levy taxes on income other than agriculture, Customs, Excise, Corporate Tax, GST on inter-state trade, etc.

The State Government has the power on land revenue, agricultural income tax, land and building tax, GST on intra-state trade, excise on alcohol, stamp duty, tax on minerals, electricity duty, etc.

To address any resultant fiscal imbalance, the sharing of central taxes with States and giving grants to States by Centre is envisaged. This is decided by an independent Finance Commission appointed by the President every five years. The task of the Commission includes recommending devolution of Central taxes to the States, laying down principles of distribution and shares of individual States. The Commission is also required to give grants and address any other matters entrusted to it in the interest of sound finance in the Presidential Terms of Reference.

In addition to the tax devolution and grants given to States based on recommendations of the Finance Commissions, the Central government gives specific purpose grants for various purposes through the respective ministries.

Central Spends

The nature of Centre’s spends can be classified as:

A. Centre’s Expenditure:

- Establishment Expenditure of the Centre

- Central Sector Schemes

- Other Central Expenditure, including those on CPSEs and Autonomous Bodies

B. Centrally Sponsored Schemes and other Transfers:

- Centrally Sponsored Schemes

- Finance Commission Transfers

- Other transfers to States

Establishment Expenditure covers Salaries of Ministries (eg., Finance, Home, Health, Education, etc.) and their spends.

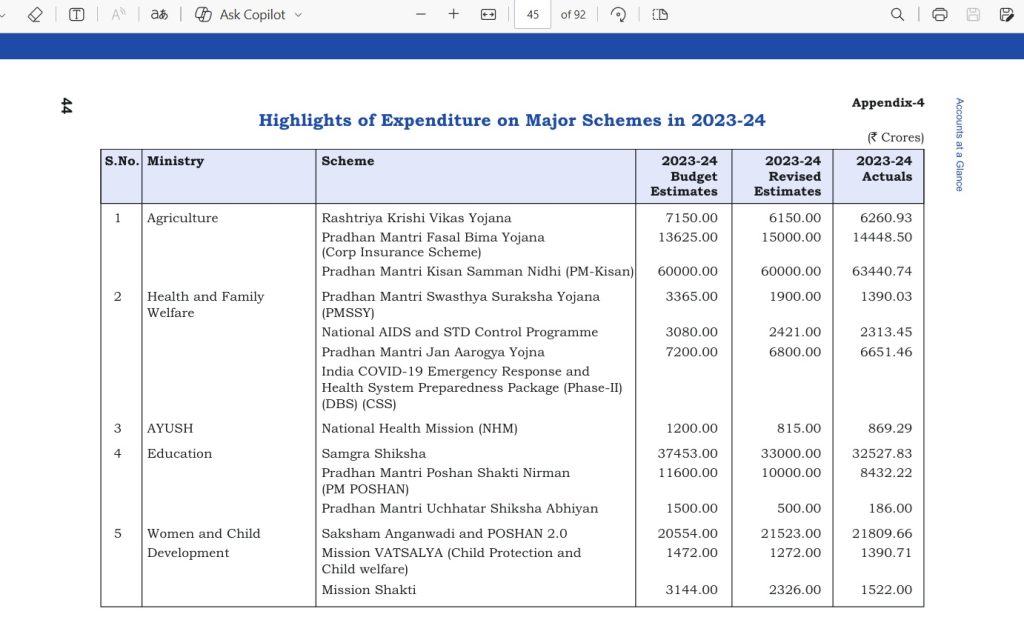

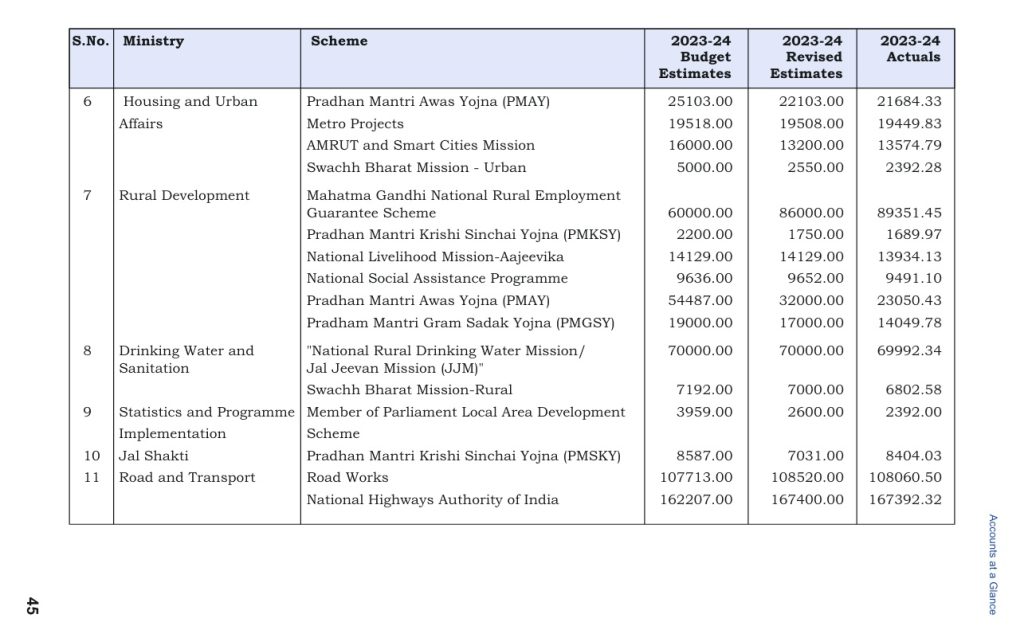

Central Sector Schemes (CS) are entirely funded by Government of India and implemented by the Central Agencies. In few cases it would be done through designated State implementing agencies. Major spends are fertiliser subsidy, Food subsidy, Defence outlays, Railway spends, NHAI, Road works, Metro projects, PM-Kisan, etc.

Other Central Expenditure includes provisions made for the Central Expenditure on CPSEs (Atomic Energy, Telecommunication, etc), Autonomous Bodies, Interest Payments, Repayment of Debt, Contributions to International Organizations etc

Centrally Sponsored Schemes (CSS) includes those schemes which are funded and implemented by both the Centre and the States as per the approved sharing pattern (MGNREGA, Jal Jeevan, PMAY, etc).

Finance Commission Transfers are the transfers to States/UTs incl. grants for local bodies, SDRF, revenue deficit grants, etc.

Other Transfers to States include transfers to States made under National Disaster Relief Fund, Assistance for schemes under 1st proviso to Article 275(1) of the Constitution etc (Compensation Cess, Special Assistance, etc)

Apart from these, resources of public enterprises constitute the total expenditure profile of Centre.

XV Finance Commission

The Fifteenth Finance Commission (XV FC) for the period 2021-26, was chaired by N. K. Singh. It recommended states’ share in the divisible pool at 41% and devolution by States using criteria like income distance, population (2011), area, forest & ecology, demographic performance and tax effort.

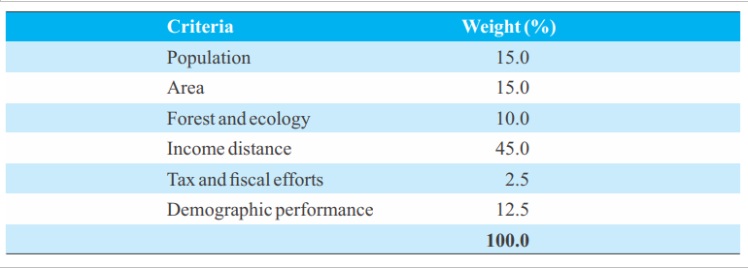

The criteria and weightage assigned for the devolution formulae are:

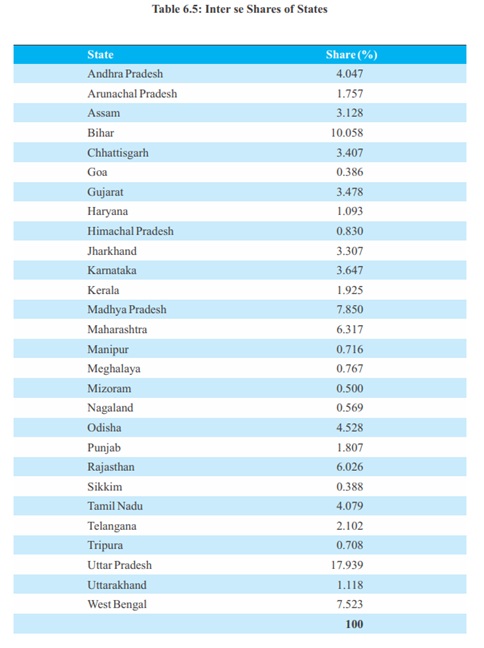

The state wise share of devolution which was formulated by the Finance Commission is:

The state wise share of devolution which was formulated by the Finance Commission is:

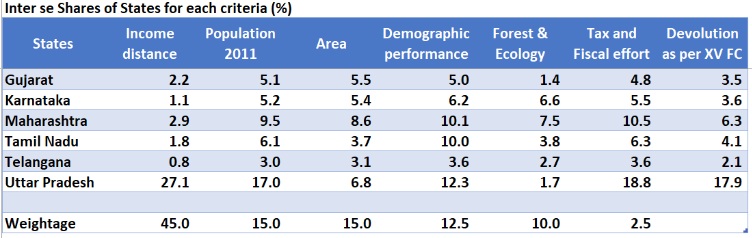

Tax Devolution by Criteria for Major States

Looking at the tax devolution by criteria for major states, you could see that the Income distance has the maximum weightage at 45% and represents the principle of equity as main criteria. Population and area share by State follows this at 15% weightage each. To reward demography performance (TFR), forest cover and tax / fiscal effort appropriate measures have been added.

Here, UP has got the maximum share most of the criteria in its favour amongst this group of states. Its low per capita income and its distance with the highest per capita state (Haryana) has the maximum inflence followed by its high population and area share.

2023-24 Actual devolution by State

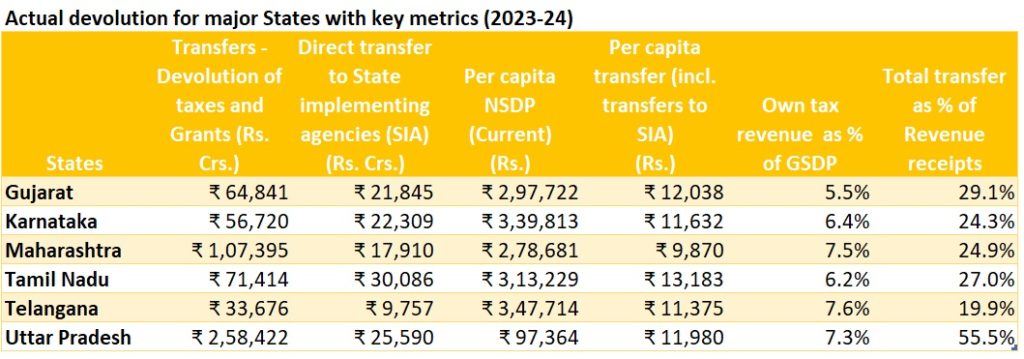

In terms of the actual devolution for these major states for the year 2023-24, the table below captures the tax devolutions and other Finance commission transfers under the total transfers. Apart from this, the respective State Finance accounts tracks the direct transfers to State implementating agencies (thro’ PFMS). These transfers pertains to Subsidies, some of the CSS and CS schemes as explained above.

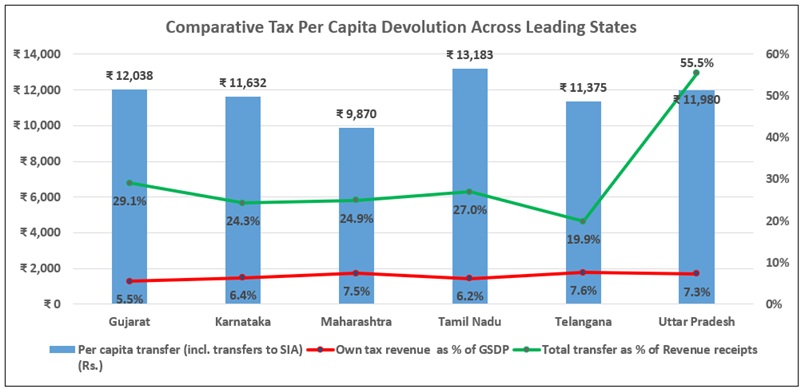

At per capita basis, these transfers (incl. that of direct transfers to SIAs) reflect that TN gets the maximum per capita transfers at Rs. 13,183 followed by Gujarat at Rs. 12,038. The own tax revenue as % of GSDP reflects the financial health of these States and is high for Telangana, Maharashtra followed by Uttar Pradesh. The quantum of transfers (excl. SIA) is highest at 55.5% for UP (reflecting the weightage shown above) followed by Gujarat (29%) and Tamil Nadu (27%).

Conclusion

These data above fairly reflect the balancing act and the principle of equity followed by Finance Commission for arriving at the tax devolution. These are typically called as general purpose funds and the transfers to SIAs are specific purpose funds. The myth that Tamil Nadu is unfairly treated by the Central Government is unfounded as the transfers are as per the independent finance commission and follows the detailed critera driven by equity and a fair distribution amongst States.

What could be looked at by XVI Finance commission is reducing the Cess collection used by Centre for specific purpose funds and other purposes and give more general-purpose funds to States driving autonomy

References

Appendix

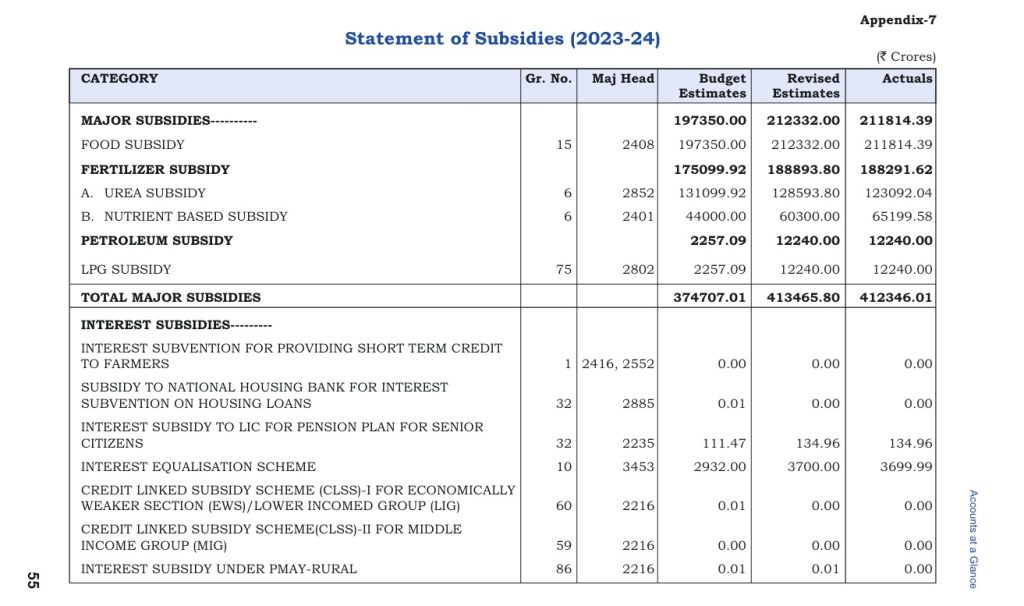

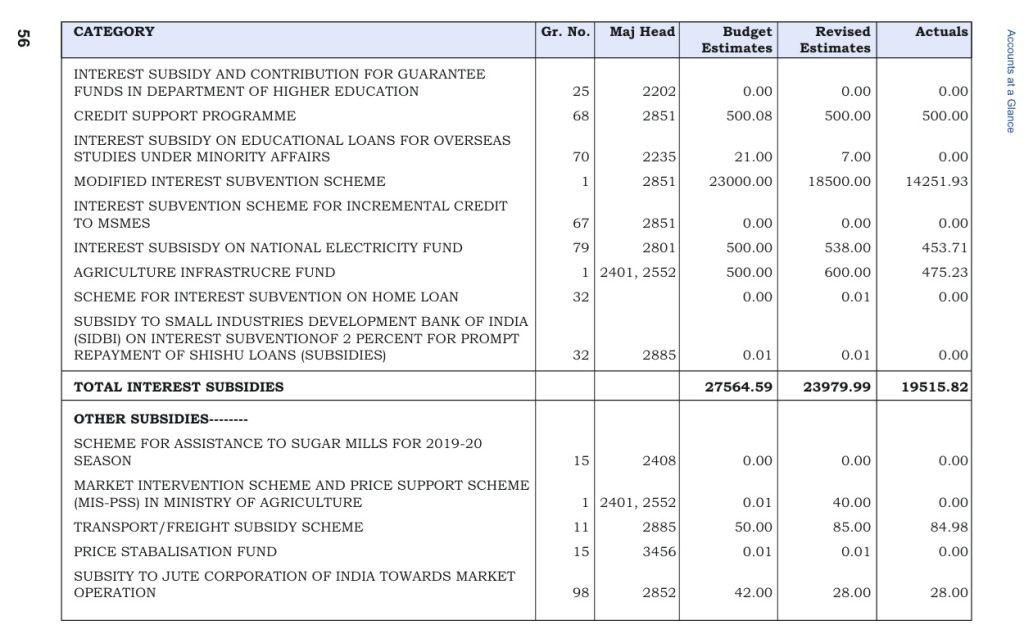

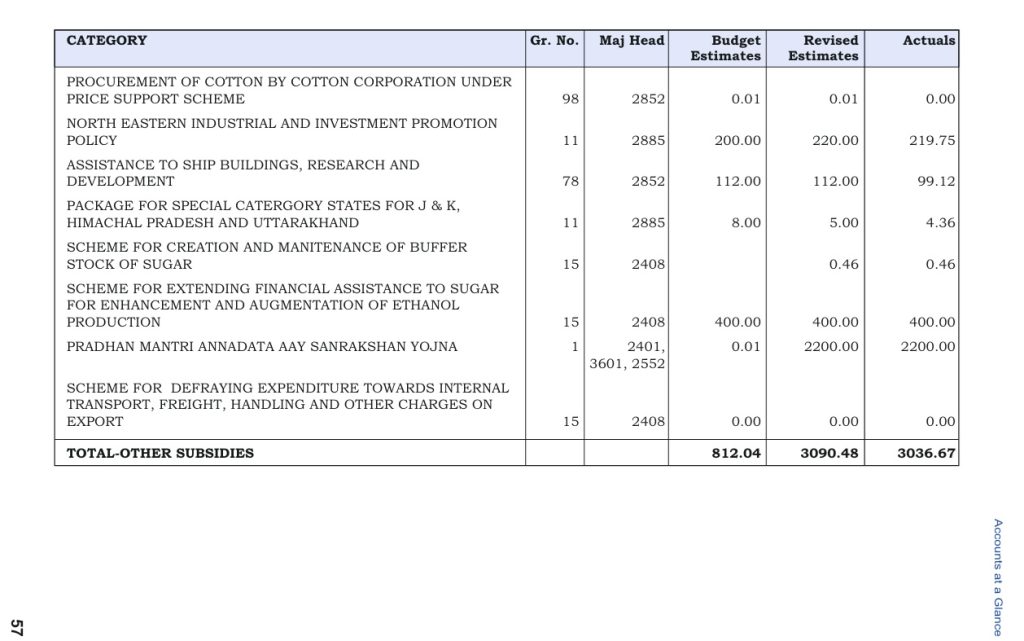

Statement of Subsidies

Central Schemes

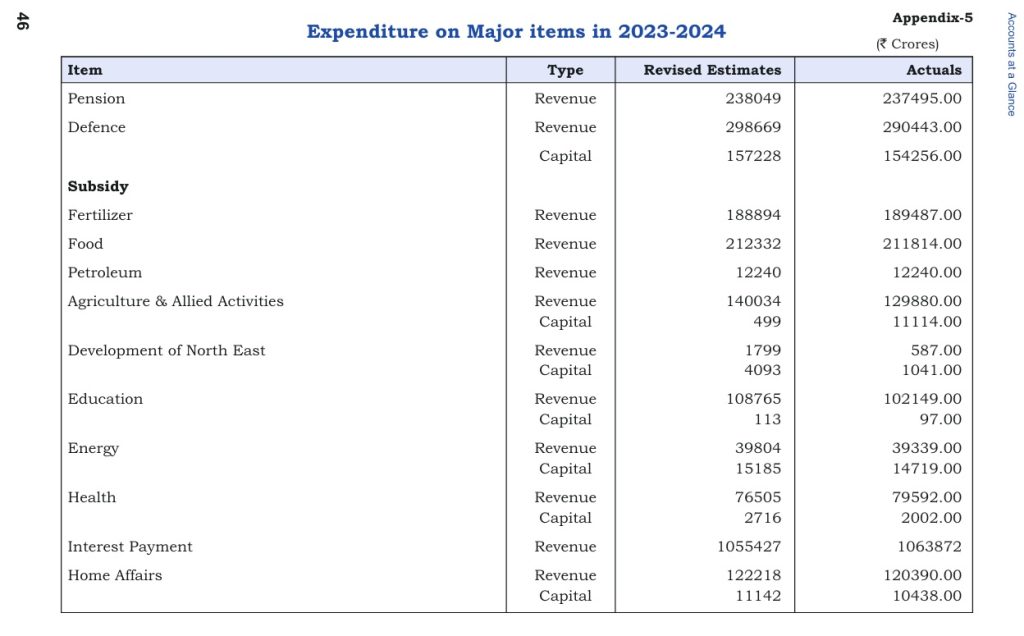

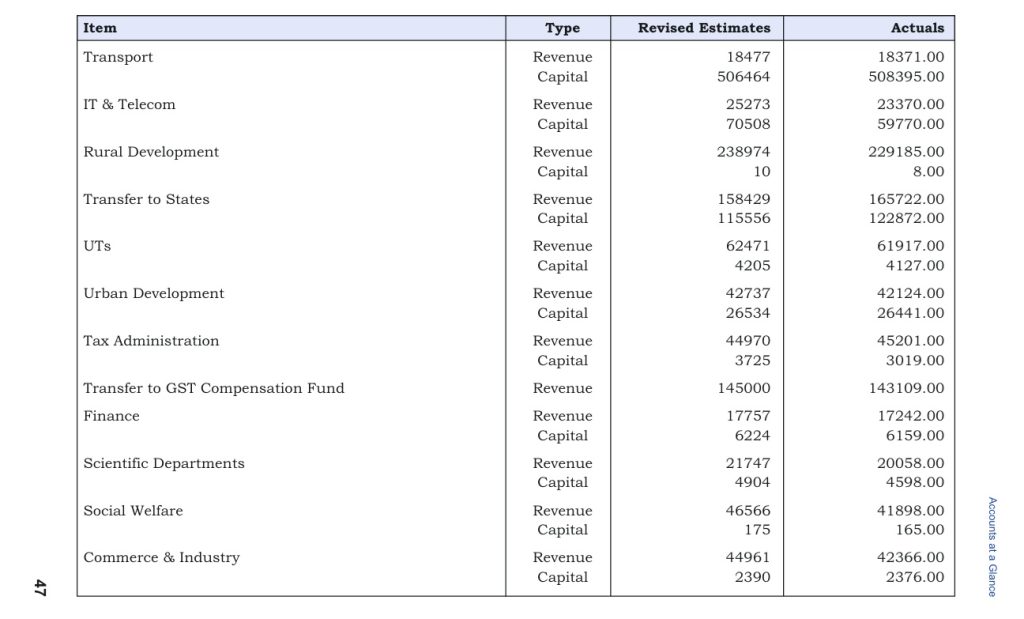

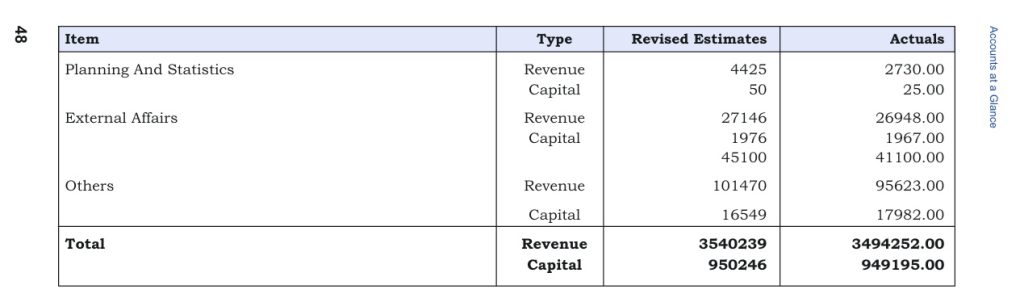

Central Expenditure

Baskar is a finance professional having keen interest in current affairs and Indian culture.

Subscribe to our channels on Telegram, WhatsApp, and Instagram and get the best stories of the day delivered to you personally.