The Congress party seems to have latched onto a GST Council clarification on popcorn taxation to deflect attention from their scion Rahul Gandhi’s reported misconduct in Parliament, where he attacked a BJP MP and intimidated a female BJP MP. By amplifying outrage over the popcorn GST rates through social media campaigns led by leaders like Jairam Ramesh, the party has sought to shift focus from the troubling allegations against its chief.

The controversy hinges on the GST Council’s clarification that “ready-to-eat” popcorn is taxed at 5% if unpackaged, 12% if pre-packaged, and 18% if coated with sugar, such as caramel popcorn. Congress has used this to accuse the BJP-led government of imposing an unnecessarily complex and burdensome tax regime. Memes and viral posts criticizing the rates have flooded social media, with Congress portraying the GST system as flawed and needing a complete overhaul.

With Congress leaders and MPs, including Jairam Ramesh, have been pushing narratives from behind the scenes through their official X accounts, questioning the GST Council’s decision by stating, “The absurdity of three different tax slabs for popcorn under GST, which has unleashed a tsunami of memes on social media, only brings to light a deeper issue: the growing complexity of a system that was supposed to be a Good and Simple Tax. GST evasion is significant, input tax credit fraud is common, and the number of bogus companies set up to ‘game’ the GST system runs into thousands. Tracking of supply chains is weak, the registration process is flawed, advantages are being taken of loopholes in turnover exemptions, compliance requirements are still cumbersome, and misclassification of goods is frequent. Recent data on tax frauds uncovered by the Directorate General of GST Intelligence (DGGI) reveal GST evasion of Rs 2.01 lakh crore in FY24. With the Union Budget now just 40 days away, will the PM and FM summon the courage to launch a complete overhaul and institute a GST 2.0?”

The absurdity of three different tax slabs for popcorn under GST, which has unleashed a tsunami of memes on social media, only brings to light a deeper issue: the growing complexity of a system that was supposed to be a Good and Simple Tax.

GST evasion is significant, input tax…

— Jairam Ramesh (@Jairam_Ramesh) December 22, 2024

Despite the narrative pushed by Congress and its allies, it’s important to note that sugary products are generally taxed at higher rates worldwide. However, the Congress has deliberately stirred controversy over this issue. It is well-established that “popcorn” is not considered a daily staple food like basic essentials and, as such, is taxed differently under various slabs.

“Ready-to-eat popcorn,” which is seasoned with salt and spices and resembles namkeens, currently attracts a 5% GST if it is not pre-packaged or labeled. If it is pre-packaged and labeled, the GST rate increases to 12%. However, when popcorn is coated with sugar (such as caramel popcorn), its classification changes to that of a sugar confectionery, which falls under HS 1704 90 90 and is taxed at 18%, according to the clarification.

Fact check ✅ alert: 🚨🚨🚨

Did you know that the much talked about popcorn issue actually has NO RATE CHANGE at all?

Yep. No change in tax rates here, just a clarification for an issue the industry raised. Popcorn, considered namkeen, was always at 5%. But when mixed with… pic.twitter.com/tbph19kipd— S Sundar Raman (@ssundarraman) December 22, 2024

This is not a new tax but a much-needed clarification. The price difference between caramel popcorn (₹99 for 120 grams) and regular popcorn (₹30) highlights the disparity in the nature of these items. The 55th GST Council Meeting on 21 December 2024, in Jaisalmer, Rajasthan, led by Finance Minister Nirmala Sitharaman, introduced several consumer-friendly decisions: Fortified Rice Kernels will now cost less due to a reduced GST rate. Life-saving drugs and gene therapies are now exempt from GST, making healthcare more affordable. Fresh green and black pepper from farmers will no longer attract GST, benefiting both farmers and consumers. Small payments up to ₹2,000 made through payment aggregators are now GST-free, potentially reducing costs for smaller transactions. Food prepared for welfare distribution is exempt from GST, potentially improving the efficiency of welfare programs. Used electric vehicles transferred between individuals remain GST-exempt, encouraging greener transportation.

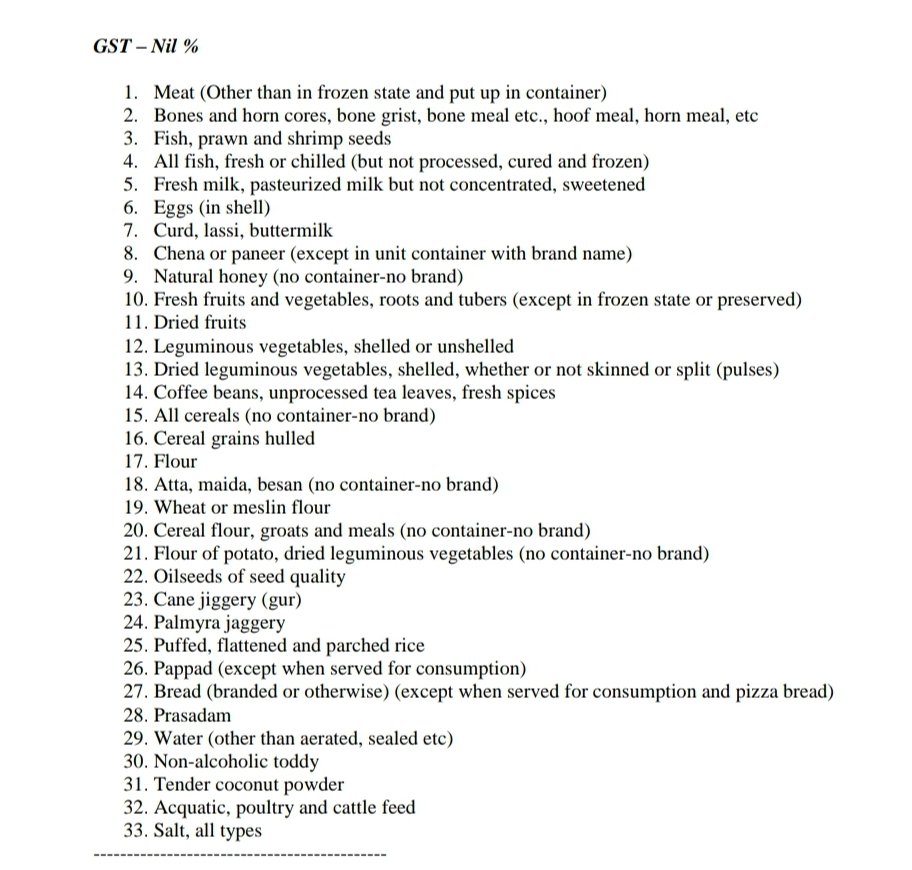

Additionally, popcorn with added sugars will be taxed at a different rate from plain popcorn, reflecting their distinct characteristics. These changes aim to reduce the tax burden on essential goods and services, benefiting sectors such as healthcare and sustainable transportation. Essential items like meat, vegetables, cereals, and non-carbonated or unpackaged water, as well as all types of salts, will continue to be 0% GST. The CBIC has also indicated that further clarification will be provided regarding the rationale behind this taxation.

Subscribe to our Telegram, WhatsApp, and Instagram channels and get the best stories of the day delivered instantly.